How would your answers differ to Exercise 5 if this were an open-book negotiated project with a

Question:

How would your answers differ to Exercise 5 if this were an open-book negotiated project with a 75–25% savings split favoring the project owner?

Data from exercise 5

Utilizing the buyout log developed in Exercise 1, if the project was to finish with exactly those buyout values equaling as-built costs, and all other estimated costs were to equal actual costs (which is unlikely), prepare a fee forecast for the project. What would the final fee for City Construction Company be? Would the owner realize any project savings? How would those savings be reflected in the final contract amount?

Data from exercise 1

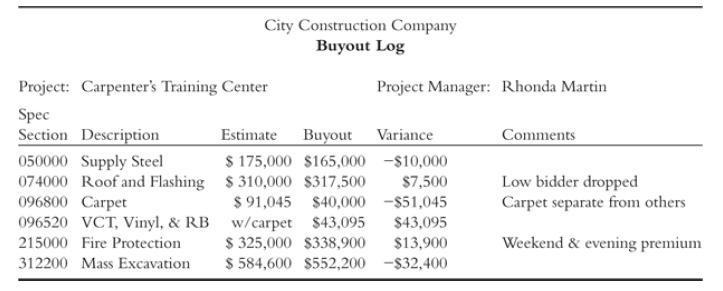

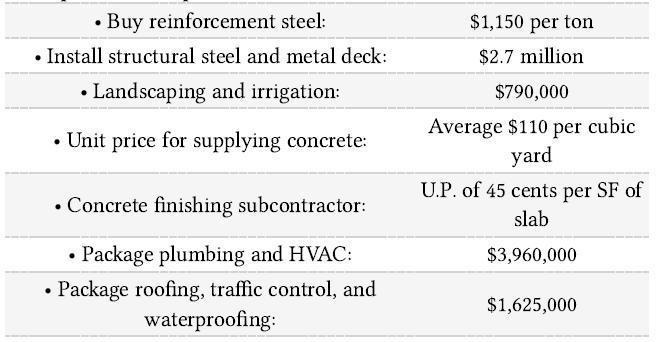

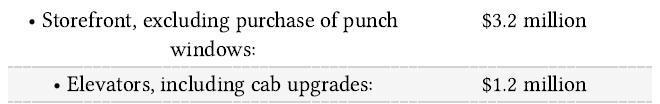

Assume the following buyout values for the case study project. Begin with the final bid estimate developed in Chapter 20 and develop a buyout log similar to Figure 24.2. You will have to look at examples presented earlier in the book and make a few derivations and assumptions to complete this exercise.

Figure 24.2

Step by Step Answer:

Construction Cost Estimating

ISBN: 9780367902681

1st Edition

Authors: John E. Schaufelberger, Len Holm