Answer the following questions: a. Assuming a rate of 10% annually, find the FV of $1,000 after

Question:

Answer the following questions:a. Assuming a rate of 10% annually, find the FV of $1,000 after 5 years.b. What is the investment?s FV at rates of 0%, 5%, and 20% after 0, 1, 2, 3, 4, and 5 years?c. Find the PV of $1,000 due in 5 years if the discount rate is 10%.d. What is the rate of return on a security that costs $1,000 and returns $2,000 after 5 years?e. Suppose California?s population is 36.5 million people and its population is expected to grow by 2% annually. How long will it take for the population to double?f. Find the PV of an ordinary annuity that pays $1,000 each of the next 5 years if the interest rate is 15%. What is the annuity?s FV?g. How will the PV and FV of the annuity in part f change if it is an annuity due?h. What will the FV and the PV be for $1,000 due in 5 years if the interest rate is 10%, semiannual compounding?

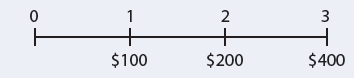

i. What will the annual payments be for an ordinary annuity for 10 years with a PV of $1,000 if the interest rate is 8%? What will the payments be if this is an annuity due?j. Find the PV and the FV of an investment that pays 8% annually and makes the following end-of-year payments:

k. Five banks offer nominal rates of 6% on deposits, but A pays interest annually, B pays semiannually, C pays quarterly, D pays monthly, and E pays daily.1.?

What effective annual rate does each bank pay? If you deposit $5,000 in each bank today, how much will you have in each bank at the end of 1 year? 2 years?2.?

If all of the banks are insured by the government (the FDIC) and thus are equally risky, will they be equally able to attract funds? If not (and the TVM is the only consideration), what nominal rate will cause all of the banks to provide the sameeffective annual rate as Bank A?3.?

Suppose you don?t have the $5,000 but need it at the end of 1 year. You plan to make a series of deposits?annually for A, semiannually for B, quarterly for C, monthly for D, and daily for E?with payments beginning today. How large must the payments be to each bank?4.?

Even if the five banks provided the same effective annual rate, would a rational investor be indifferent between the banks? Explain.l. Suppose you borrow $15,000. The loan?s annual interest rate is 8%, and it requires four equal end-of-year payments. Set up an amortization schedule that shows the annual payments, interest payments, principal repayments, and beginning and ending loan balances.

AnnuityAn annuity is a series of equal payment made at equal intervals during a period of time. In other words annuity is a contract between insurer and insurance company in which insurer make a lump-sum payment or a series of payment and, in return,... Discount Rate

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal... Nominal Rates

"Nominal interest rate refers to the interest rate before taking inflation into account. Nominal can also refer to the advertised or stated interest rate on a loan, without taking into account any fees or compounding of interest. The nominal...

Step by Step Answer:

Fundamentals of Financial Management

ISBN: 978-1337395250

15th edition

Authors: Eugene F. Brigham, Joel F. Houston