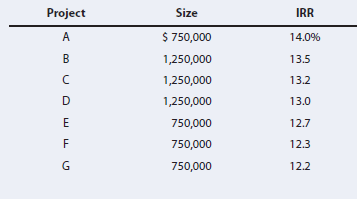

Hampton Manufacturing estimates that its WACC is 12.5%.The company is considering the following 7 investment projects: a.

Question:

Hampton Manufacturing estimates that its WACC is 12.5%.The company is considering the following 7 investment projects:

a. Assume that each of these projects is independent and that each is just as risky as the firm?s existing assets. Which set of projects should be accepted, and what is the firm?s optimal capital budget?b. Now assume that Projects C and D are mutually exclusive. Project D has an NPV of $400,000, whereas Project C has an NPV of $350,000. Which set of projects should be accepted, and what is the firm?s optimal capital budget?c. Ignore part b and assume that each of the projects is independent but that management decides to incorporate project risk differentials. Management judges Projects B, C, D, and E to have average risk, Project A to have high risk, and Projects F and G to have low risk. The company adds 2% to the WACC of those projects that are significantly more risky than average, and it subtracts 2% from the WACC of those projects that are substantially less risky than average. Which set of projects should be accepted, and what is the firm?s optimal capital budget?

Step by Step Answer:

Fundamentals of Financial Management

ISBN: 978-1337395250

15th edition

Authors: Eugene F. Brigham, Joel F. Houston