During the year, 30,000 units were produced and sold. The following actual costs were incurred: Direct materials

Question:

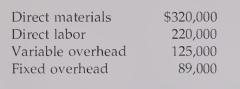

During the year, 30,000 units were produced and sold. The following actual costs were incurred:

Direct materials $320,000 Direct labor 220,000 Variable overhead 125,000 Fixed overhead 89,000 There were no beginning or ending inventories of raw materials. The materials price variance was $5,000 unfavorable. In producing the 30,000 units, 39,000 hours were worked, 4% more hours than the standard allowed for the actual output. 0\'erhead costs are applied to production using direct labor hours.

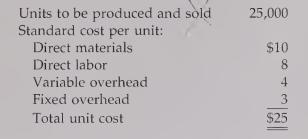

Correr Company manufactures a line of running shoes. At the beginning of the period, the following plans for production and costs were revealed;

During the year, 30,000 units were produced and sold. The following actual costs were incurred:

There were no beginning or ending inventories of raw materials. The materials price variance was $5,000 unfavorable. In producing the 30,000 units, 39,000 hours were worked, 4% more hours than the standard allowed for the actual output. 0\'erhead costs are applied to production using direct labor hours.

Required:

1. Prepare a flexible budget showing the total expected costs for the actual production.

Also prepare a performance report comparing expected costs to actual costs.

2. Determine the following:

a. Materials usage variance

b. Labor rate variance

c. Labor usage variance

d. Fixed overhead spending and volume variances

e. Variable overhead spending and efficiency variances 3. Use T-accounts to show the flow of costs through the system. In showing the flow, you do not need to show detailed overhead variances. Show only the over- and underap¬

plied variances for fixed and variable overhead.

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324002324

3rd Edition

Authors: Don R. Hansen, Maryanne M. Mowen