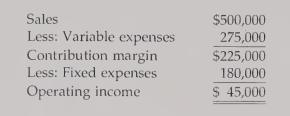

The income statement for Sanders, Inc., is as follows: Required: 1. Compute the unit contribution margin and

Question:

The income statement for Sanders, Inc., is as follows:

Required:

1. Compute the unit contribution margin and the units that must be sold to break even.

Suppose that 30,000 units are sold above the break-even point. What is the profit?

2. Compute the contribution margin ratio and the break-even point in dollars. Suppose that revenues are $200,000 greater than expected. What would the total profit be?

3. Compute the margin of safety.

4. Compute the operating leverage. Compute the new profit level if sales are 20% higher than expected.

5. How many units must be sold to earn a profit equal to 10% of sales?

6. Assume the tax rate is 40%. How manyunits must be sold to earn an after-tax profit of

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324002324

3rd Edition

Authors: Don R. Hansen, Maryanne M. Mowen