T Ltd. was placed in voluntary liquidation on 31 December, 2016, when the Balance Sheet was as

Question:

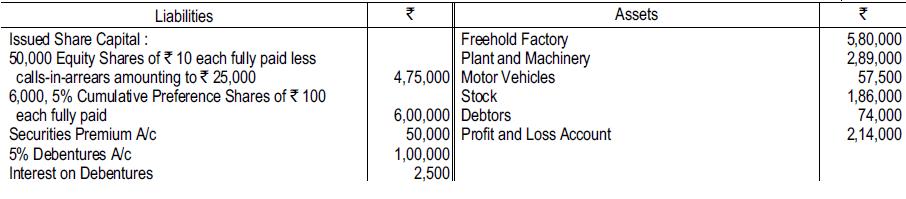

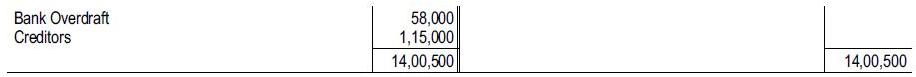

T Ltd. was placed in voluntary liquidation on 31 December, 2016, when the Balance Sheet was as follows:

The preference dividends in arrears from 2013 onwards. The company’s article provide that on liquidation, out of the surplus assets remaining after payment of liquidation costs and outside liabilities, there shall be paid firstly all arrears of preference dividend, secondly the amount paid-up on the preference shares together with a premium thereon of ₹ 10 per share, and thirdly any balance then remaining

shall be paid to the equity shareholders. The Bank overdraft was guaranteed by the directors who were called upon by the bank to discharge their liability under the guarantee. The directors paid the amount to the bank. The liquidator realised the assets as follows:

Freehold factory ---- ₹ 7,00,000;

Plant and machinery ---- ₹ 2,40,000;

Motor vehicles ---- ₹ 59,000;

Stock ---- ₹ 1,50,000;

Debtors ---- ₹ 60,000;

Calls-in-arrears ---- ₹ 25,000. Creditors were paid less discount of 5%. The debentures and accrued interest were repaid on 31st March, 2017.

Liquidation cost were ~ 3,820 and the liquidator’s remuneration was 2% on the amount realised. Prepare a Liquidator’s Statement of Account.

Step by Step Answer:

Corporate Accounting As Per The Companies Act 2013 Including Rules 2014 And 2015

ISBN: 9789352605569

2nd Edition

Authors: M Hanif, A Mukherjee