The authorised capital of Moon Ltd. is 5,00,000 consisting of 2,000, 6% Preference Shares of 100 each

Question:

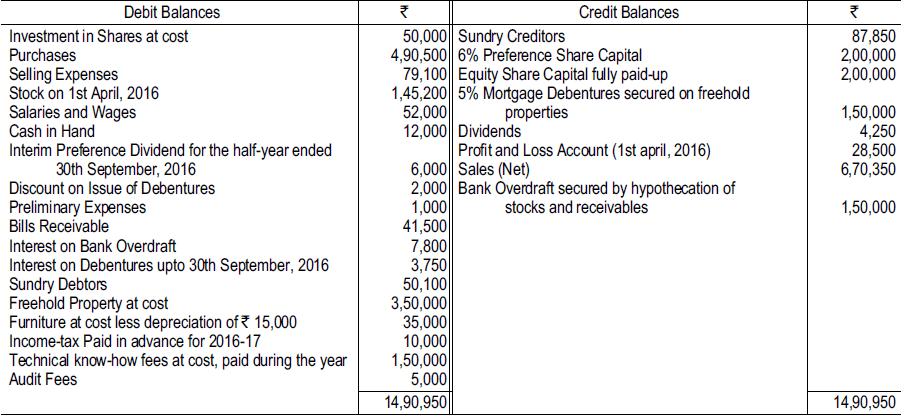

The authorised capital of Moon Ltd. is ₹5,00,000 consisting of 2,000, 6% Preference Shares of ₹100 each and 30,000 Equity Shares of ₹10 each. The following was the Trial Balance of Moon Ltd. as on 31st March, 2017:

You are required to prepare Statement of Profit and Loss for the year ended 31st March, 2017 and the Balance Sheet as on that date after taking into account the following :

(i) Closing stock was valued at ₹ 1,42,500.

(ii) Purchases include ₹ 5,000 worth of goods and articles distributed among valued customers.

(iii) Salaries and wages include ₹ 2,000 being wages incurred for installation of electrical fittings which were recorded under furniture.

(iv) Bills receivable include ₹ 1,500 being dishonoured bills, 50% of which had been considered irrecoverable.

(v) Bills receivable of ₹ 2,000 maturing after 31st March, 2017 were discounted.

(vi) Depreciation on furniture to be charged @ 10% on written down value.

(vii) Discount on issue of debentures to be written off fully.

(viii) Interest on debentures for the half year ended on 31st March, 2017 was due on that date.

(ix) Provide provision for taxation ₹ 4,000.

(x) Technical knowwhow fees is to be written off over a period of 10 years.

(xi) Preliminary expenses are to be written off fully.

(xii) Salaries and wages include ₹ 10,000 being directors’ remuneration.

(xiii) Sundry debtors include ₹ 6,000 debts due for more than 6 months.

(xiv) Rate of corporate dividend tax is 17%. Keeping in mind the requirements of Part I and Part II of Schedule III of the Companies Act, 2013, prepare Statement of Profit and Loss for the year ended 31st March, 2017 and Balance Sheet as on that date of Moon Ltd as close thereto as possible. Figures for the previous year can be ignored.

Step by Step Answer:

Corporate Accounting As Per The Companies Act 2013 Including Rules 2014 And 2015

ISBN: 9789352605569

2nd Edition

Authors: M Hanif, A Mukherjee