For 2020, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders.

Question:

For 2020, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders.

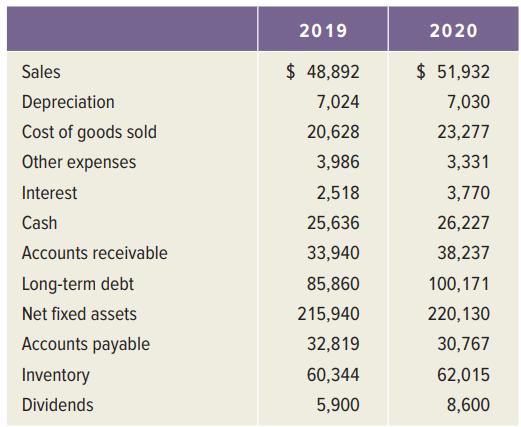

Use the following information for Ingersoll, Inc., (assume the tax rate is 25 percent):

2019 2020 Sales $ 48,892 $ 51,932 Depreciation 7,024 7,030 Cost of goods sold 20,628 23,277 Other expenses 3,986 3,331 Interest 2,518 3,770 Cash 25,636 26,227 Accounts receivable 33,940 38,237 Long-term debt 85,860 100,171 Net fixed assets 215,940 220,130 Accounts payable 32,819 30,767 Inventory 60,344 62,015 Dividends 5,900 8,600

Step by Step Answer:

OCF EBIT Depreciation Taxes OCF 18294 7030 3631 OCF 21693 Change in NWC NWCend NWCbeg CA CLend CA CL...View the full answer

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

For 2012, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders. Use the following information for Ingersoll, Inc., for (assume the tax rate is 34percent): 2011...

-

For 2017, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders. Use the following information for Ingersoll, Inc., (assume the tax rate is 35 percent): 2016 2017...

-

Deep Water Experts is the largest retailer of diving equipment for professional and recreational divers in the UAE. The company was founded in 2005 as a joint partnership and has experienced...

-

Which of the following is not an element of the fraud triangle? (a) Rationalization. (b) Financial pressure. (c) Segregation of duties. (d) Opportunity.

-

Recall that phishing describes an attempt to extract personal/financial information from unsuspecting people through fraudulent e-mail. The interarrival times (in seconds) for 267 fraud box e-mail...

-

Which smartphone/tablet has the most innovative features and functionality? What are those features/ functionality and how do they stand out from competitors features? (pp. 258259)

-

15. A European shout option is an option for which the payoff at expiration is max(0, S K, G K), where G is the price at which you shouted. (Suppose you have an XYZ shout call with a strike price...

-

Management of a soft-drink bottling company has the business objective of developing a method for allocating delivery costs to customers. Although one cost clearly relates to travel time within a...

-

One-Year Trailing Returns Miranda Fund 10.2% 37% Return Standard deviation. Beta 1.10 S&P 500 -22.5% 44% 1.00

-

Selected transactions of Coromandel Ltd are given on the next page. The company uses straight-line depreciation and calculates depreciation expense to the nearest whole month. 2015 Jan. 4 April 10...

-

Draw up an income statement and balance sheet for this company for 2019 and 2020. Use the following information for Ingersoll, Inc., (assume the tax rate is 25 percent): 2019 2020 Sales $ 48,892 $...

-

If Hailey, Inc., has an equity multiplier of .85, total asset turnover of 2.10, and a profit margin of 5.97 percent, what is its ROE?

-

Using the assumptions in the chapter, prepare a flexible budget for the coming month for Finkler Corporation assuming that sales are either 36,000 or 44,000 units.

-

2vx Voy Ax g 2vo cos 0 sin 0 g vo sin(20) g

-

PORTAGE COLLEGE Diversity Awareness Course Score | Home | Help | Exit Module 2 Post-Test Module 1 Module 2 Module 3 Module 2 Post-Test Betsy really likes working at Thompson Trucking. She likes how...

-

Suppose f(x) = 5x cos x. Find the equation of the tangent line to f(x) at the point (, -5). y = x+

-

First, for this case study, define the ethical dilemma facing "John". Second, isn't the collectability of an account ultimately based on opinion? If so , how does that play in the ethical dilemma...

-

Does the game have a dominant-strategy equilibrium? If so, what is it and why is it that? If not, why not?

-

In Problem use the Laplace transform to solve the given integral equation or integrodifferential equation. t 2f(t) = (e e) f(t T) dr

-

Where are the olfactory sensory neurons, and why is that site poorly suited for their job?

-

Growth Rate In the context of the dividend growth model, is it true that the growth rate in dividends and the growth rate in the price of the stock are identical?

-

Growth Rate In the context of the dividend growth model, is it true that the growth rate in dividends and the growth rate in the price of the stock are identical?

-

Voting Rights When it comes to voting in elections, what are the differences between US political democracy and U.S. corporate democracy?

-

Los datos de la columna C tienen caracteres no imprimibles antes y despus de los datos contenidos en cada celda. En la celda G2, ingrese una frmula para eliminar cualquier carcter no imprimible de la...

-

Explain impacts of changing FIFO method to weighted average method in inventory cost valuations? Explain impacts of changing Weighted average method to FIFO method in inventory cost valuations?...

-

A perpetuity makes payments starting five years from today. The first payment is 1000 and each payment thereafter increases by k (in %) (which is less than the effective annual interest rate) per...

Study smarter with the SolutionInn App