Draw up an income statement and balance sheet for this company for 2019 and 2020. Use the

Question:

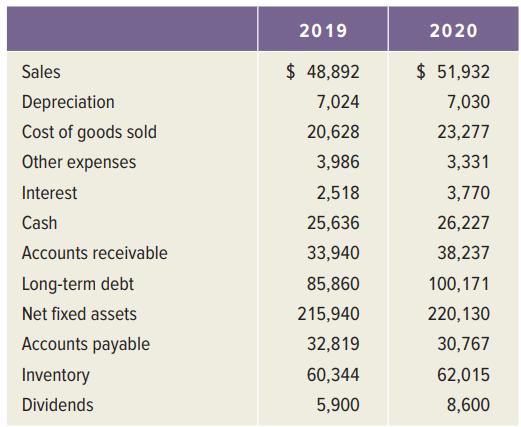

Draw up an income statement and balance sheet for this company for 2019 and 2020.

Use the following information for Ingersoll, Inc., (assume the tax rate is 25 percent):

2019 2020 Sales $ 48,892 $ 51,932 Depreciation 7,024 7,030 Cost of goods sold 20,628 23,277 Other expenses 3,986 3,331 Interest 2,518 3,770 Cash 25,636 26,227 Accounts receivable 33,940 38,237 Long-term debt 85,860 100,171 Net fixed assets 215,940 220,130 Accounts payable 32,819 30,767 Inventory 60,344 62,015 Dividends 5,900 8,600

Step by Step Answer:

Balance sheet as of Dec 31 2019 Cash 25636 Accounts payable 32819 Accounts receivable 3...View the full answer

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

An incomplete comparative income statement and balance sheet for Emore Corporation follow: Requirment 1. Using the ratios, common-size percentages, and trend percentages given, complete the...

-

An incomplete comparative income statement and balance sheet for Amherst Corporation follow: Requirement 1. Using the ratios, common-size percentages, and trend percentages given, complete the income...

-

Income statement and balance sheet information abstracted from a recent annual report of Wolverine World Wide, Inc. appears below: The significant accounting policies note disclosure contained the...

-

The use of prenumbered checks in disbursing cash is an application of the principle of: (a) establishment of responsibility. (b) segregation of duties. (c) physical controls. (d) documentation...

-

Refer to the Bulletin of Marine 0 Science (April 2010) observational study of teams fishing for the red spiny lobster in Baja California Sur, Mexico, Exercise 6.29. Trap spacing measurements (in...

-

You copy an album cover online from your favorite CD and post it to your Facebook page. Infringement or not? (pp. 258259)

-

14. For the lookback put: a. What is the value of a lookback put if St = 0? Verify that the formula gives you the same answer. b. Verify that at maturity the value of the put is ST ST .

-

In June 2007, General Electric (GE) had a book value of equity of $117 billion, 10.3 billion shares outstanding, and a market price of $38.00 per share. GE also had cash of $16 billion, and total...

-

Why is it necessary to consider the economic and demographic environment in assessing a governments financial condition? How is the budgetary cushion calculated, and why should a government maintain...

-

A 1.75 mole sample of an ideal gas is compressed isothermally from 62.0 L to 19.0 L using a constant external pressure of 2.80 atm. Calculate q, w, U, and H.

-

Consider the following abbreviated financial statements for Weston Enterprises: WESTON ENTERPRISES 2020 Income Statement Sales....................$17,259 Costs.......................5,113...

-

For 2020, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders. Use the following information for Ingersoll, Inc., (assume the tax rate is 25 percent): 2019 2020...

-

Capital project evaluation Romiss Company is evaluating a proposal to acquire several new lathes for its production department. The cost of the equipment is $68,000. In addition, the company would...

-

Working in the production area of a manufacturing company is right where William feels at home. Several of his family members had worked in similar environments throughout their careers, and he loves...

-

Use the Nernst equation and reduction potential data from (Petrucci's Appendix D; OpenStax's Table 16.1) to calculate Ecell for the following cell: Al (s) | Al3+ (0.18 M) || Fe+ (0.85 M) | Fe (s)

-

1.) Describe economic interventions that the federal government used to deal with the COVID shutdown and subsequent inflation. Would you have done anything differently? 2.) Describe three of the...

-

The goal is to understand the principles of project valuation and capital budgeting in a practical setting, using a combination of fictitious data and real-world examples. Begin by proposing a...

-

45. The use of realistic predetermined unit costs to facilitate product costing, cost control, cost flow, and inventory valuation is a description of the A. flexible budget concept. B. budgetary...

-

In problem use Problems 41 and 42 and the fact that (1/2) = to find the Laplace transform of the given function. f(t) = t 3/2 Problems 41 and 42 Theorem 7.1.1 I'(a) = 1a-le- dt, a 0. %3D

-

Starr Co. had sales revenue of $540,000 in 2014. Other items recorded during the year were: Cost of goods sold ..................................................... $330,000 Salaries and wages...

-

Common versus Preferred Stock Suppose a company has a preferred stock issue and a common stock issue. Both have just paid a $2 dividend. Which do you think will have a higher price, a share of the...

-

Dividend Growth Model Based on the dividend growth model, what are the two components of the total return on a share of stock? Which do you think is typically larger?

-

Dividend Growth Model Based on the dividend growth model, what are the two components of the total return on a share of stock? Which do you think is typically larger?

-

When credit terms for a sale are 2/15, n/40, the customer saves by paying early. What percent (rounded) would this savings amount to on an annual basis

-

An industrial robot that is depreciated by the MACRS method has B = $60,000 and a 5-year depreciable life. If the depreciation charge in year 3 is $8,640, the salvage value that was used in the...

-

What determines a firm's beta? Should firm management make changes to its beta? Be sure to consider the implications for the firm's investors using CAPM.

Study smarter with the SolutionInn App