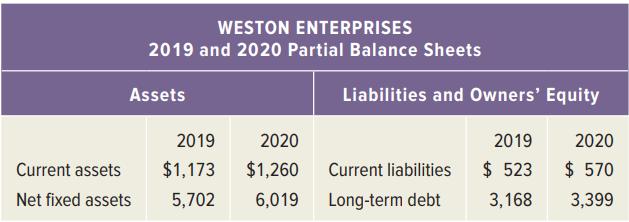

Consider the following abbreviated financial statements for Weston Enterprises: WESTON ENTERPRISES 2020 Income Statement Sales....................$17,259 Costs.......................5,113 Depreciation.........1,472

Question:

Consider the following abbreviated financial statements for Weston Enterprises:

WESTON ENTERPRISES

2020 Income Statement

Sales....................$17,259

Costs.......................5,113

Depreciation.........1,472

Interest paid...........618

a. What was owners’ equity for 2019 and 2020?

b. What was the change in net working capital for 2020?

c. In 2020, the company purchased $3,050 in new fixed assets. How much in fixed assets did the company sell? What was the cash flow from assets for the year? The tax rate is 25 percent.

d. During 2020, the company raised $697 in new long-term debt. How much long-term debt must the company have paid off during the year? What was the cash flow to creditors?

Step by Step Answer:

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan