Refer back to Table 10.2 . What range of returns would you expect to see 68 percent

Question:

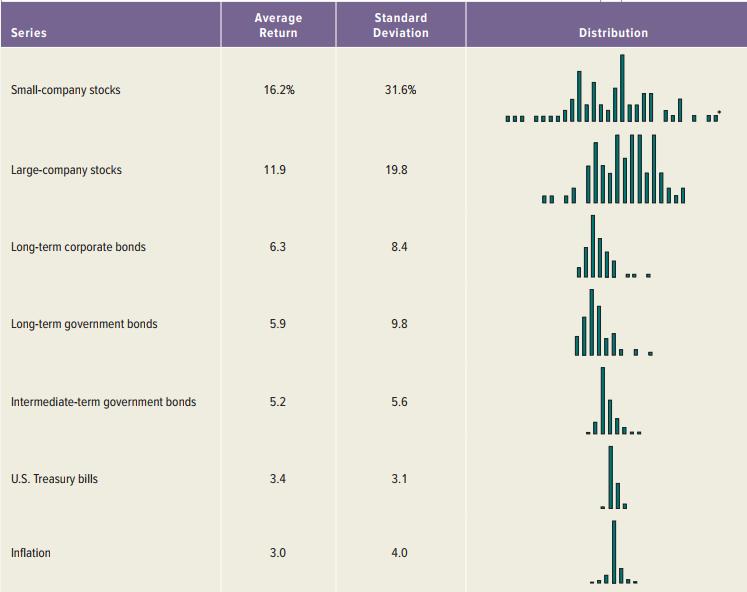

Refer back to Table 10.2. What range of returns would you expect to see 68 percent of the time for long-term corporate bonds? What about 95 percent of the time?

Average Return Standard Series Deviation Distribution Small-company stocks 16.2% 31.6% Large-company stocks 11.9 19.8 Long-term corporate bonds 6.3 8.4 Long-term government bonds 5.9 9.8 Intermediate-term government bonds 5.2 5.6 U.S. Treasury bills 3.4 3.1 Inflation 3.0 4.0 ..ili..

Step by Step Answer:

Looking at the longterm corporate bond return history in Table 102 we see that the mean ...View the full answer

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Related Video

Stocks (also known as equities) are securities that represent ownership in a company. They are issued by companies to raise capital, and when an individual buys stocks, they become a shareholder in that company. Investing in stocks can be a way for individuals to potentially earn a return on their investment through dividends and capital appreciation. However, investing in stocks also carries a level of risk, as the value of the stock can fluctuate based on various factors such as the financial performance of the company and general market conditions. For companies, issuing stocks can be a way to raise funds for growth and expansion. When a company goes public by issuing an initial public offering (IPO), it can raise significant capital by selling ownership stakes to the public. Companies can also issue additional stock offerings to raise additional capital as needed.

Students also viewed these Business questions

-

Refer back to Table 10.2. What range of returns would you expect to see 68 percent of the time for long-term corporate bonds? What about 95 percent of the time? Table 10.2 AVERAGE STANDARD SERIES...

-

Refer back to Table 10.2. What range of returns would you expect to see 68 percent of the time for large-company stocks? What about 95 percent of the time? AVERAGE STANDARD SERIES RETURN DEVIATION...

-

Refer back to figure 10.10. What range of returns would you expect to see 68 percent of the time for long-term corporate bonds? What about 95 percent of thetime? Average Standard returndeviation...

-

. Suppose that the city of New York issues bonds to raise money to pay for a new tunnel linking New Jersey and Manhattan. An investor named Susan buys one of the bonds on the same day that the city...

-

Numerical measures of variation for level of support for the 992 senior managers are shown in the accompanying Minitab printout. For Information: Refer to the Business and Society (March 2011) study...

-

What is the role of the OD practitioner in community intervention?

-

What factors do consumers usually consider when selecting a financial institution?

-

Three point charges are arranged on a line. Charge q3 = + 5.00 nC and is at the origin. Charge q2 = - 3.00 nC and is at x = +4.00cm. Charge q1 is at x = +2.00cm. What is q1 (magnitude and sign) if...

-

Please answer. Sheridan Accounting performs two types of services, Audit and Tax. Sheridan's estimated overhead costs consist of computer support, $ 270000; and legal support, $ 135000. information...

-

fiduciary funds 7c. part 1. private purpose trust fund transactions the city of monroe scholarship foundation private-purpose trust fund had the following account balances on january 1, 2015: debits...

-

You bought a stock three months ago for $61.18 per share. The stock paid no dividends. The current share price is $64.32. What is the APR of your investment? The EAR?

-

Refer back to Table 10.2 . What range of returns would you expect to see 68 percent of the time for large-company stocks? What about 95 percent of the time? Average Return Standard Series Deviation...

-

Prove Liebeck's triplet prime conjecture: the only triplet of primes of the form \(p, p+2, p+4\) is \(\{3,5,7\}\).

-

A company must decide between scrapping or reworking units that do not pass inspection. The company has 16,000 defective units that have already cost $132,000 to manufacture. The units can be sold as...

-

according to the phase rule, the triple point of a pure substance is A. invariant B. u nivariant C. bivariant D. none of the above

-

33. If the equipment in the previous question had sold for $15,000, the correct entry would be: a. Cash debit $15,000. Gain credit $3,000. $12,000 Equipment credit b. Cash debit $15,000. Debit a loss...

-

The banks play a central role in financial intermediation in New Zealand. 1.What is financial intermediation? Who performs it? and why is it important? 2.What is Qualitative Asset transformation...

-

Consider the following information attributed to the material management department Budgeted usage of materials - handling labor - hours 3,700 Budgeted cost pools: Fixed costs $166,500 Variable costs...

-

The differential equation (1 x 2 )y'' xy' + a 2 y = 0 where is a parameter, is known as Chebyshevs equation after the Russian mathematician Pafnuty Chebyshev (18211894). When = n is a nonnegative...

-

Evaluate each logarithm to four decimal places. log 0.257

-

This problem illustrates a deceptive way of quoting interest rates called add-on interest. Imagine that you see an advertisement for Crazy Judy's Stereo City that reads something like this: "$1,000...

-

Your Christmas ski vacation was great, but it unfortunately ran a bit over budget. All is not lost: You just received an offer in the mail to transfer your $10,000 balance from your current credit...

-

An insurance company is offering a new policy to its customers. Typically the policy is bought by a parent or grandparent for a child at the child's birth. The details of the policy are as follows:...

-

Berbice Inc. has a new project, and you were recruitment to perform their sensitivity analysis based on the estimates of done by their engineering department (there are no taxes): Pessimistic Most...

-

#3) Seven years ago, Crane Corporation issued 20-year bonds that had a $1,000 face value, paid interest annually, and had a coupon rate of 8 percent. If the market rate of interest is 4.0 percent...

-

I have a portfolio of two stocks. The weights are 60% and 40% respectively, the volatilities are both 20%, while the correlation of returns is 100%. The volatility of my portfolio is A. 4% B. 14.4%...

Study smarter with the SolutionInn App