Suppose you are offered a project with the following cash flows: a. What is the IRR of

Question:

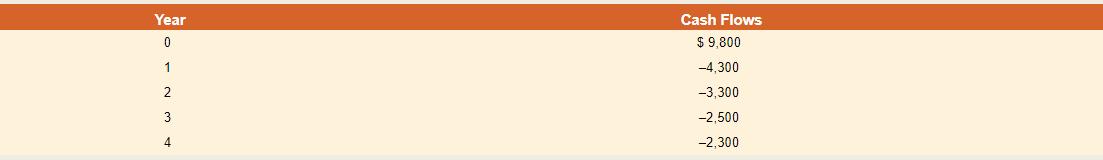

Suppose you are offered a project with the following cash flows:

a. What is the IRR of this project?

b. If the appropriate discount rate is 10 percent, should you accept this project?

c. If the appropriate discount rate is 20 percent, should you accept this project?

d. What is the NPV of the project if the appropriate discount rate is 10 percent? 20 percent?

e. Are the decisions under the NPV rule in part (d) consistent with those of the IRR rule?

Year 0 1 2 3 4 Cash Flows $9,800 -4,300 -3,300 -2,500 -2,300

Step by Step Answer:

Answer and thorough explanation a What is the IRR of this project The IRR is the discount rate that ...View the full answer

Corporate Finance

ISBN: 9781260772388

13th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

Related Video

The internal rate of return, or IRR, is a metric used to measure the profitability of an investment. It is the discount rate that makes the net present value of an investment equal to zero. To calculate the IRR, we need to know the investment\'s cash flows. These are the inflows and outflows of cash that will result from the investment. For example, an investment in a property might have cash outflows for the purchase price, closing costs, and any renovations, and cash inflows from rent and eventual sale of the property. The IRR is the discount rate at which the NPV of the investment is equal to zero. There are many ways to calculate IRR, from simple spreadsheet functions to more complex financial modeling software. It\'s worth noting that IRR can be a bit tricky when it comes to projects that don\'t have a consistent cash flow over time. These types of investments are known as \"irregular cash flow\" and the IRR might be misleading or not suitable to calculate. There are other metrics to evaluate these investments such as Modified Internal Rate of Return (MIRR) which is a variation of IRR and is used to get more accurate results.

Students also viewed these Business questions

-

Suppose you are offered a project with the following payments. a. What is the IRR of this offer? b. If the appropriate discount rate is 10 percent, should you accept this offer? c. If the appropriate...

-

Suppose you are offered a project with the following payments. YEAR...............................................CASH FLOWS ($) 0......................................................$14,700...

-

Suppose you are offered a project with the following payments. Year ..........Cash Flows 0 ....................$ 15,900 1 .......................5,900 2 .......................5,700 3...

-

Misty Cumbie worked as a waitress at the Vita Caf in Portland, Oregon. The caf was owned and operated by Woody Woo, Inc. Woody Woo paid its servers an hourly wage that was higher than the states...

-

Wisconsin state Senator Jesse P. Rude has charged that state employees in Madison are often too stoned to work. He thinks as many as 10 percent of all state workers in Madison are frequent users of...

-

How does issuing bonds at a premium or discount "adjust the contract rate to the applicable market rate of interest"?

-

Link Back to Chapter 4 (Closing Entries). Record the following selected transactions in the general journal of Recognition Systems. Explanations are not required. 20x2 Dec. 21 31 31 20X3 Jan. 20...

-

Rapid Delivery, Inc. is considering the purchase of an additional delivery vehicle for $38,000 on January 1, 2010. The truck is expected to have a five-year life with an expected residual value of...

-

Discuss the key legal attributes of a company? How does a company differ from a partnership business structure? 1000 words

-

1. 19 of 22 participants (86.36%) from the high-power posing group took a gambling risk to double their money, while 12 of 20 (60%) from the low-power posing group took the gambling risk. Use a...

-

Symons Sausage Corporation is trying to choose between the following two mutually exclusive design projects: a. If the required return is 10 percent and the company applies the profitability index...

-

Vince plans to open a self-serve grooming center in a storefront. The grooming equipment will cost $365,000, to be paid immediately. Vince expects aftertax cash inflows of $79,000 annually for 7...

-

Throughout the system development and implementation project, the IT auditor will make control recommendations to management resulting from identified findings. Explain why recommendations from IT...

-

Financial Statement Items Identify the financial statement (or statements) in which each of the following items would appear: income statement (IS), statement of stockholders' equity (SSE), balance...

-

Recall from Chapter 4 that Tiger Stripe Copy Center is a small business located near a large university campus. Tiger Stripe Copy offers a range of services to walk-in customers, including passport...

-

Accounting Processes Identify the following processes as either measuring or communicating. a. Prepare financial statements for the entity b. Identify relevant economic activities of the entity c....

-

To estimate future values of the cost indices, one is tempted to assume that the average value for the year occurred at midyear (June 30-July 1) and that the linear fit to the recent data can be...

-

Reston Manufacturing Corporation produces a cosmetic product in three consecutive processes. The costs of Department | for May 2016 were as follows: Department | handled the following units during...

-

Find the exact value of expression. Do not use a calculator. tan 20/cot 70

-

Provide examples of a situations in which environmental disruptions affected consumer attitudes and buying behaviors.

-

Can our goal of maximizing the value of the stock conflict with other goals, such as avoiding unethical or illegal behavior? In particular, do you think subjects like customer and employee safety,...

-

Would our goal of maximizing the value of the stock be different if we were thinking about financial management in a foreign country? Why or why not?

-

Would our goal of maximizing the value of the stock be different if we were thinking about financial management in a foreign country? Why or why not?

-

Your company BMG Inc. has to liquidate some equipment that is being replaced. The originally cost of the equipment is $120,000. The firm has deprecated 65% of the original cost. The salvage value of...

-

1. What are the steps that the company has to do in time of merger transaction? And What are the obstacle that may lead to merger failure? 2.What are the Exceptions to not to consolidate the...

-

Problem 12-22 Net Present Value Analysis [LO12-2] The Sweetwater Candy Company would like to buy a new machine that would automatically "dip" chocolates. The dipping operation currently is done...

Study smarter with the SolutionInn App