Suppose you observe the following situation: a. Calculate the expected return on each stock. b. Assuming the

Question:

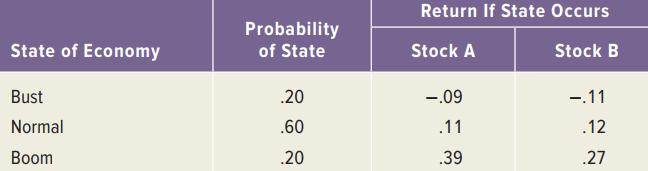

Suppose you observe the following situation:

a. Calculate the expected return on each stock.

b. Assuming the capital asset pricing model holds and Stock A’s beta is greater than Stock B’s beta by .34, what is the expected market risk premium?

Transcribed Image Text:

Return If State Occurs Probability State of Economy of State Stock A Stock B Bust .20 -.09 -.11 Normal .60 .11 .12 Boom .20 .39 .27

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 62% (8 reviews)

a The expected return of an asset is the sum of the probability of each return occurring times the p...View the full answer

Answered By

Hassan Ali

I am an electrical engineer with Master in Management (Engineering). I have been teaching for more than 10years and still helping a a lot of students online and in person. In addition to that, I not only have theoretical experience but also have practical experience by working on different managerial positions in different companies. Now I am running my own company successfully which I launched in 2019. I can provide complete guidance in the following fields. System engineering management, research and lab reports, power transmission, utilisation and distribution, generators and motors, organizational behaviour, essay writing, general management, digital system design, control system, business and leadership.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Question Posted:

Students also viewed these Business questions

-

Suppose you observe the following situation: a. Calculate the expected return on each stock. b. Assuming the capital asset pricing model holds and Stock As beta is greater than Stock Bs beta by .43,...

-

Suppose you observe the following situation: a. Calculate the expected return on each stock. b. Assuming the capital asset pricing model holds and stock As beta is greater than stock Bs beta by .40,...

-

SML Suppose you observe the following situation: a. Calculate the expected return on each stock. b. Assuming the capital asset pricing model holds and stock A??s beta is greater than stock B??s beta...

-

A semicircular plate of radius r, oriented as in the figure, is submerged in fluid of density 68 lb/ft 3 so that its diameter is located at a depth of m feet. Calculate the force on one side of the...

-

Hierarchical file names always start at the top of the tree. Consider, for example, the file name /usr/ast/books/mos2/chap-12 rather than chap-12/mos2/books/ast/usr. In contrast, DNS names start at...

-

The human factors in budget preparation are more important than its technical intricacies. Explain. LO3

-

Why change product line depth?

-

A partial list of the accounts and ending account balances taken from the post closing trial balance of the Jordan Corporation on December 31, 2007 is shown as follows: Account Title Amount Retained...

-

Hurst Company purchased an apartment building in 1986 for $700,000. The building is sold in 2018 for $900,000. The actual depreciation deducted on the building as of the sale date was $600,000....

-

Refer to Exercise 13-48. Suppose that Kamber is considering building a new plant inside a foreign trade zone to replace its chemical manufacturing plant. Kamber, Inc., owns a factory located close...

-

The Angelina Corporations common stock has a beta of 1.08. If the risk-free rate is 3.7 percent and the expected return on the market is 10 percent, what is the companys cost of equity?

-

Suppose you observe the following situation: Assume these securities are correctly priced. Based on the CAPM, what is the expected return on the market? What is the risk-free rate? Security Beta...

-

Write each expression in simplest radical form. If a radical appears in the denominator, rationalize the denominator.

-

Archer Contracting repaved 50 miles of two-lane county roadway with a crew of six employees. This crew worked 8 days and used \($7,000\) worth of paving material. Nearby, Bronson Construction repaved...

-

An insurance company has the following profitability analysis of its services: The fixed costs are distributed equally among the services and are not avoidable if one of the services is dropped. What...

-

The Scantron Company makes bar-code scanners for major supermarkets. The sales staff estimates that the company will sell 500 units next year for 10,000 each. The production manager estimates that...

-

Determine the following: a. The stockholders equity of a company that has assets of \(\$ 625,000\) and liabilities of \(\$ 310,000\). b. The retained earnings of a company that has assets of \(\$...

-

You are the manager of internal audit for Do-It-All, Ltd., a large, diversified, decentralized manufacturing company. Over the past two years, the information systems function in Do-It-All has...

-

Find two power series solutions of the given differential equation about the ordinary point x = 0. Compare the series solutions with the solutions of the differential equations obtained using the...

-

From the choice of simple moving average, exponential smoothing, and linear regression analysis, which forecasting technique would you consider the most accurate? Why? please write it in word...

-

Suppose the Japanese yen exchange rate is 126 = $1, and the British pound exchange rate is 1 = $1.53. a. What is the cross-rate in terms of yen per pound? b. Suppose the cross-rate is 195.8 = 1. Is...

-

The treasurer of a major U.S. firm has $30 million to invest for three months. The annual interest rate in the United States is .17 percent per month. The interest rate in Great Britain is .61...

-

Suppose the current exchange rate for the Polish zloty is Z 3.29. The expected exchange rate in three years is Z 3.41. What is the difference in the annual inflation rates for the United States and...

-

Yard Professionals Incorporated experienced the following events in Year 1, its first year of operation: Performed services for $31,000 cash. Purchased $7,800 of supplies on account. A physical count...

-

This question is from case # 24 of book Gapenski's Cases in Healthcare Finance, Sixth Edition Select five financial and five operating Key Performance Indicators (KPIs) to be presented at future...

-

assume that we have only two following risk assets (stock 1&2) in the market. stock 1 - E(r) = 20%, std 20% stock 2- E(r) = 10%, std 20% the correlation coefficient between stock 1 and 2 is 0. and...

Study smarter with the SolutionInn App