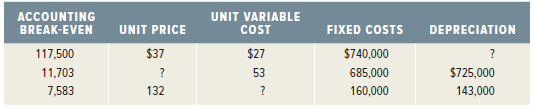

In each of the following cases, find the unknown variable. Ignore taxes. ACCOUNTING BREAK-EVEN UNIT VARIABLE UNIT

Question:

ACCOUNTING BREAK-EVEN UNIT VARIABLE UNIT PRICE $37 FIXED COSTS COST DEPRECIATION 117,500 11,703 7,583 $27 $740,000 685,000 160,000 53 $725,000 143,000 132

Step by Step Answer:

We can use the accounting breakeven equation Q A ...View the full answer

Corporate Finance Core Principles and Applications

ISBN: 978-1259289903

5th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

Find the EAR in each of the following cases (Use 365 days a year. Do not round intermediate calculations and round your final answers to 2 decimal places. (e.g., 32.16)): Stated Rate (APR) Number of...

-

In each of the following cases discuss how you, as a portfolio manager, would use financial futures to protect the portfolio. a. You own a large position in a relatively illiquid bond that you want...

-

In each of the following cases involving travel expenses, indicate how each item is reported on the taxpayers tax return. Include any limitations that might affect its deductibility. a. Marilyn lives...

-

Evan participates in an HSA carrying family coverage for himself, his spouse, and two children. In 2018, Evan has $100 per month deducted from his paycheck and contributed to the HSA. In addition,...

-

Presented below are several figures reported for Plate Corporation and Saucer Industries as of December 31, 2014. The cost of the 70% investment was equal to 70% of the book value of Saucer's net...

-

The term symbol for the ground state of N 2 + is 2 g + . What is the total spin and total orbital angular momentum of the molecule? Show that the term symbol agrees with the electron configuration...

-

Discuss postpurchase outcomes.

-

If i = 6%, compute the value of D that is equivalent to the two disbursements shown. 200 100

-

On January 1, Year 2, the Accounts Receivable balace was $37,000 and the balance in the Allowance for Doubtful Accounts was $2,800. On January 15, Year 2, an $800 uncollectible account was...

-

Describe three high-contact service operations and three low-contact service operations. Do the concepts of intangibility and unstorability have different implications for low- and high-contact...

-

Butters Company acquires equipment at a cost of $42,000 on January 3, 2014. Management estimates the equipment will have a residual value of $6,000 at the end of its four-year useful life. Assume the...

-

Refer to the data given for Butters Company in BE95. Assume instead that the company uses the diminishing-balance method and that the diminishing-balance depreciation rate is double the straight-...

-

What are known as separate expenses and joint expenses?

-

Refer to the information presented in M7-9. Suppose that Juanita has developed a rectangular, medium-size ceramic pot. It requires 3 hours of kiln time; however, two medium-size pots can fit m the...

-

Eclipse Company manufactures a variety of sunglasses. Production information for its most popular line, the Total Eclipse (TE), follows: Suppose that Eclipse has been approached about making a...

-

Sunblocker Corp. makes several varieties of beach umbrellas and accessories. It has been approached about producing a special order for custom umbrellas. The special-order umbrellas with the Randolph...

-

Sunblocker Corp. is considering eliminating a product from its Happy Sand line of beach umbrellas. This collection is aimed at people who spend time on the beach or have an outdoor patio near the...

-

Suppose that annual demand for a certain item has decreased dramatically this year, although the store that stocks this item has not updated its inventory policy, so the store is still using the same...

-

Simplify. Assume that all variables represent positive real numbers. (75 + 4) (25 - 1)

-

Why are stocks usually more risky than bonds?

-

This is a comprehensive project evaluation problem bringing together much of what you have learned in this and previous chapters. Suppose you have been hired as a financial consultant to Defense...

-

Shanken Corp. issued a 30-year, 5.9 percent semiannual bond 6 years ago. The bond currently sells for 108 percent of its face value. The company's tax rate is 35 percent. a. What is the pretax cost...

-

For the firm in the previous problem, suppose the book value of the debt issue is $35 million. In addition, the company has a second debt issue on the market, a zero coupon bond with 12 years left to...

-

Slow Roll Drum Co. is evaluating the extension of credit to a new group of customers. Although these customers will provide $198,000 in additional credit sales, 13 percent are likely to be...

-

Wendell's Donut Shoppe is investigating the purchase of a new $39,600 conut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings...

-

1.Discuss the challenges faced with Valuing Stocks and Bonds. As part of this discussion, how will the selected item be implemented in an organization and its significance? 2. Discuss how Valuing...

Study smarter with the SolutionInn App