C. F. Lee, Inc., is considering a scale-enhancing project. The market value of the firms debt is

Question:

C. F. Lee, Inc., is considering a scale-enhancing project. The market value of the firm’s debt is $100 million and the market value of the firm’s equity is $200 million. The debt is considered risk-free. The corporate tax rate is 21 percent. Regression analysis indicates that the beta of the firm’s equity is 2. The risk-free rate is 10 percent and the expected market premium is 8.5 percent. What would the project’s discount rate be in the hypothetical case that C. F. Lee, Inc., is all equity?

We can answer this question in two steps.

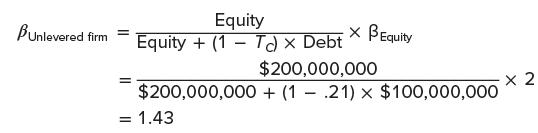

1. Determining beta of hypothetical all-equity firm: Rearranging Equation 18.4, we have this:

2. Determining discount rate: We calculate the discount rate if the firm were all equity by applying the CAPM to the beta of the unlevered firm:![Rs = RF + B x [E(RM) - RF] = .10+ 1.43 x .085 = .2219, or 22.19%](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/5/4/5/245655c42dd60b221700545245028.jpg)

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe