Clement plc is evaluating three investment projects, whose expected cash flows are given in Table 6.4. Calculate

Question:

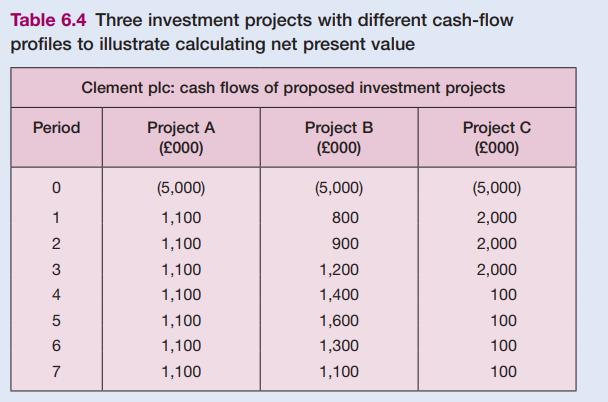

Clement plc is evaluating three investment projects, whose expected cash flows are given in Table 6.4. Calculate the net present value for each project if Clement’s cost of capital is 10 per cent and suggest which of the two projects should be selected.

Transcribed Image Text:

Table 6.4 Three investment projects with different cash-flow profiles to illustrate calculating net present value Clement plc: cash flows of proposed investment projects Project B Project A (000) Project C (000) (000) Period 0 1 2 234 3 567 (5,000) 1,100 1,100 1,100 1,100 1,100 1,100 1,100 (5,000) 800 900 1,200 1,400 1,600 1,300 1,100 (5,000) 2,000 2,000 2,000 100 100 100 100

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (5 reviews)

Project A The cash inflows of this project are identical and so do not need to be discounted separately Instead we can use the cumulative present value factor CPVF or annuity factor for seven years at ...View the full answer

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Corporate Finance Principles And Practice

ISBN: 9781292450940

9th Edition

Authors: Denzil Watson, Antony Head

Question Posted:

Students also viewed these Business questions

-

Clement plc is evaluating three investment projects, whose expected cash flows were given in Table 6.4. Calculate the internal rate of return for each project. If Clements cost of capital is 10 per...

-

The Think-Big Development Co. is a major investor in commercial real estate development projects. It currently has the opportunity to share in three large construction projects: Project 1: A...

-

Allied Food Products is considering expanding into the fruit juice business with a new fresh lemon juice product. Assume that you were recently hired as assistant to the director of capital budgeting...

-

Josie's new job has a yearly salary of $42,000. Her salary will increase by $4000 each year thereafter. If Josie works for at this job for 30 years how much will she have been paid total over the 30...

-

Describe what is meant by theft of cash through skimming.

-

What are the advantages and disadvantages of a marketnicher competitive strategy?

-

Systematic Versus Unsystematic Risk Classify the following events as mostly systematic or mostly unsystematic: (a) The Bank of Englands base rate increases unexpectedly. (b) A company renegotiates...

-

Ironhaus Restaurant Corporation wholesales ovens and ranges to restaurants throughout the Southwest. Ironhaus Restaurant Corporation, which had 40,000 shares of common stock outstanding, declared a...

-

The following relates to a proposed equipment purchase: \ table [ [ Initial investment,$ 1 4 4 , 0 0 0

-

Explain why the payback method cannot be recommended as the main method used by a company to assess potential investment projects.

-

UK consumer confidence hovered around a 50-year low last month as Britons struggled against a backdrop of soaring inflation, political turmoil and high borrowing costs, according to new data. The...

-

The following appears on the web site of Chatham Financial, an advisory service: Kennett Square, Pa., June 21, 2010 Chatham Financial announced today that it advised Primus Capital in the defeasance...

-

An important first step of exploratory data analysis is always to visualize the data. Construct a scatterplot of each time series (i.e., two different plots). If you need pointers on how to make a...

-

Cleanie Wombat Cleanie Wombat is a small Australian company that makes cleaning products. The chemical formulas used for its products were developed through R&D conducted by the company's small R&D...

-

As a manager at Yummy Melts, Martin is responsible for the firm's Just Right brand of ice cream. He recently approved a proposal to test market new ice cream flavors. He is also considering the...

-

Cogenesis Corporation is replacing their current steam plant with a 6-megawatt cogeneration plant that will produce both steam and electric power for their operations. What is the impact of a 5% and...

-

Suppose ABC firm is considering an investment that would extend the life of one of its facilities for 5 years. The project would require upfront costs of $9.97M plus $28.94M investment in equipment....

-

Prove that ||u + v||2 + ||u - v||2 = 2||u||2 + 2||v||2.

-

Evaluate how many lines there are in a true rotational spectrum of CO molecules whose natural vibration frequency is w = 4.09 1014 s1 and moment of inertia I = 1.44 1039 g cm2.

-

ABC Company and XYZ Company need to raise funds to pay for capital improvements at their manufacturing plants. ABC Company is a well-established firm with an excellent credit rating in the debt...

-

What is the duration of a bond with three years to maturity and a coupon of 5.3 percent paid annually if the bond sells at par?

-

Refer to Table 25.2 in the text to answer this question. Suppose today is December 4, 2020, and your firm produces breakfast cereal and needs 180,000 bushels of corn in March 2021 for an upcoming...

-

Prepare journal entries to record each of the following transactions of a merchandising company . The company uses a perpetual inventory system and the gross method. Nov. 5 Purchased 1,000 units of...

-

Lululemon, a Canada-based retailer, is facing increased competition from less expensive alternatives to its $100 yoga pants. However, instead of lowering prices or expanding beyond its own 440 stores...

-

Which of the following is calculated by dividing net income by revenues? Multiple Choice Gross profit margin Current ratio Net profit margin Asset turnover

Study smarter with the SolutionInn App