It is 1 January 2010 and Magnet plc is in the process of divesting part of its

Question:

It is 1 January 2010 and Magnet plc is in the process of divesting part of its operations via a proposed management buyout (MBO). The buyout team is currently looking for venture capital to finance the MBO. They have agreed a price of £25m with Magnet and have proposed that the financing will involve their putting up £5m of their personal funds to purchase an equity stake in the business with the remaining funds (£20m)

coming from the venture capitalist in the form of long-term unsecured mezzanine debt finance.

The venture capitalist has indicated that it will require an interest rate on its debt investment of 11 per cent given that its finance will be unsecured. The four members of the MBO team have indicated that they intend to draw an annual salary of

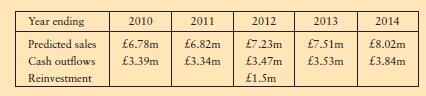

£150 000 each. The MBO team has just presented the venture capitalist company with the following five-year cash flow predictions (excluding directors’ salaries) which they consider to be on the pessimistic side:

The new entity will pay corporate tax at a rate of 20 per cent in the year that profits arise. The reinvestment of £1.5m in 2012 will not qualify for capital allowances.

On the basis of this information, critically evaluate whether the proposed MBO is viable from a cash flow perspective in light of the two parties’ financial requirements and the predicted sales and costs. Support your answer with appropriate calculations.

Step by Step Answer:

Corporate Finance Principles And Practice

ISBN: 9780273725343

5th Edition

Authors: Denzil Watson, Antony Head