Locate the Treasury bond in Figure 8.5 maturing in November 2041. Is this a premium or a

Question:

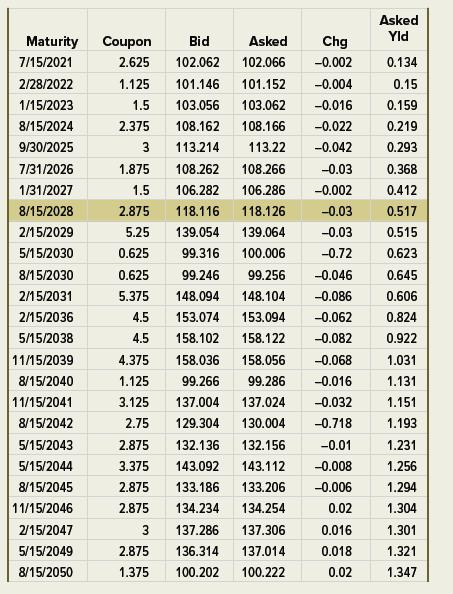

Locate the Treasury bond in Figure 8.5 maturing in November 2041. Is this a premium or a discount bond? What is its current yield? What is its yield to maturity? What is the bid-ask spread in dollars? Assume a par value of $10,000.

Figure 8.5

Transcribed Image Text:

Maturity Coupon Bid 7/15/2021 2.625 102.062 2/28/2022 1/15/2023 8/15/2024 9/30/2025 7/31/2026 1/31/2027 8/15/2028 2/15/2029 5/15/2030 8/15/2030 2/15/2031 2/15/2036 5/15/2038 11/15/2039 8/15/2040 11/15/2041 8/15/2042 Asked Chg 102.066 -0.002 1.125 101.146 101.152 -0.004 1.5 103.056 103.062 -0.016 2.375 108.162 108.166 -0.022 3 113.214 113.22 -0.042 1.875 108.262 108.266 1.5 106.282 106.286 2.875 118.116 118.126 5.25 139.054 0.625 99.316 0.625 5.375 148.094 153.074 158.102 4.375 158.036 158.056 1.125 99.266 99.286 3.125 137.004 137.024 2.75 129.304 5/15/2043 5/15/2044 8/15/2045 11/15/2046 2/15/2047 5/15/2049 8/15/2050 -0.03 -0.002 -0.03 -0.03 -0.72 -0.046 148.104 -0.086 153.094 -0.062 158.122 -0.082 -0.068 -0.016 -0.032 130.004 -0.718 2.875 132.136 132.156 3.375 143.092 143.112 2.875 133.186 2.875 134.234 4.5 4.5 139.064 100.006 99.246 99.256 -0.01 -0.008 133.206 -0.006 134.254 0.02 3 137.286 137.306 2.875 136.314 137.014 1.375 100.202 100.222 0.016 0.018 0.02 Asked Yld 0.134 0.15 0.159 0.219 0.293 0.368 0.412 0.517 0.515 0.623 0.645 0.606 0.824 0.922 1.031 1.131 1.151 1.193 1.231 1.256 1.294 1.304 1.301 1.321 1.347

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 42% (7 reviews)

The Treasury bond in Figure 85 maturing in November 2041 is a premium bond This is because the bond ...View the full answer

Answered By

Branice Buyengo Ajevi

I have been teaching for the last 5 years which has strengthened my interaction with students of different level.

4.30+

1+ Reviews

10+ Question Solved

Related Book For

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

Question Posted:

Students also viewed these Business questions

-

Locate the Treasury bond in Figure 5.4 that matures in August 2039. Is this a premium or a discount bond? What is its current yield? What is its yield to maturity? What is the bid-ask spread in...

-

Locate the Treasury bond in Figure 5.4 maturing in February 2039. Is this a premium or a discount bond? What is its current yield? What is its yield to maturity? What is the bid-ask spread? d 2. 2 3...

-

Locate the Treasury bond in Figure 5.4 maturing in August 2028. What is its coupon rate? What is its bid price? What was the previous days asked price? d 2. 2 3 3 3 3 3 3 3 3 3 4 4 4 4 4 4 4 4 4 4 4...

-

The rigid bar AB is supported by a pin at B and by two the cables AC (perpendicular to the beam) and AD (inclined with respect to the beam) attached at A as shown in Fig. 3. A C 30 in D B 80 in...

-

Think of a co-worker, fellow student, or friend who seems to have a high need for power. What methods or tactics does this person use to try to influence others? Explain.

-

Multicore CPUs are beginning to appear in conventional desktop machines and laptop computers. Desktops with tens or hundreds of cores are not far off. One possible way to harness this power is to...

-

How does conducting a stakeholder analysis help the project manager and project team understand the informal organization? AppendixLO1

-

Describe some demand management techniques that are used when demand exceeds capacity and when capacity exceeds demand.

-

Lease or Sell Astro Company owns a equipment with a cost of $362,300 and accumulated depreciation of $52,300 that can be sold for $276,700, less a 5% sales commission. Alternatively, Astro Company...

-

What is the end-of-year wealth if Vicki Bogan receives an APR of 24 percent compounded monthly on a $1 investment? Using Equation 4.6, her wealth is: The annual rate of return is 26.82 percent. This...

-

The preceding material can be further explained by the following example. We keep our one-factor model here but make three specific assumptions: 1. All securities have the same expected return of 10...

-

Target Corporation prepares its financial statements according to U.S. GAAP. Targets financial statements and disclosure notes for the year ended February 3, 2018, are available in Connect. This...

-

Dr. Burgess oversees the pharmacy center within Hughes Regional Hospital. Dr. Burgess is planning on purchasing two medication dispensing units which she wants to pay back in a short-term period. The...

-

On January 1, 2021, Wetick Optometrists leased diagnostic equipment from Southern Corp., which had purchased the equipment at a cost of $1,831,401. The lease agreement specifies six annual payments...

-

Prevosti Farms and Sugarhouse pays its employees according to their job classification. The following employees make up Sugarhouse's staff: Employee Whatis late and Address Payroll information A -...

-

Image caption

-

Jamie Lee and Ross, now 57 and still very active, have plenty of time on their hands now that the triplets are away at college. They both realized that time has just flown by, over twenty-four years...

-

Which inventory cost flow assumption is allowed under U.S. GAAP but not under IFRS? Explain why some U.S. companies will lobby strongly to keep this method as an allowable alternative.

-

Do public and private companies follow the same set of accounting rules? Explain.

-

Are poison pills good or bad for stockholders? How do you think acquiring firms are able to get around poison pills?

-

Describe the advantages and disadvantages of a taxable merger as opposed to a tax-free exchange. What is the basic determinant of tax status in a merger? Would an LBO be taxable or nontaxable?...

-

Describe the advantages and disadvantages of a taxable merger as opposed to a tax-free exchange. What is the basic determinant of tax status in a merger? Would an LBO be taxable or nontaxable?...

-

En prenant un exemple de votre choix, montrer comment on value un swap de taux de change.

-

How much would you need to invest today in order to receive: a. $10,000 in 5 years at 11%? b. $11,000 in 12 years at 8%? c. $12,000 each year for 10 years at 8%? d. $12,000 at the beginning of each...

-

A company that manufactures pulse Doppler insertion flow meters uses the Straight Line method for book depreciation purposes. Newly acquired equipment has a first cost of $190,000 with a 3-year life...

Study smarter with the SolutionInn App