1. 20. Net non-current assets and depreciation [LO 2.4] On the statement of financial position, the net...

Question:

1. 20.

Net non-current assets and depreciation [LO 2.4] On the statement of financial position, the net non-current assets (NFA) account is equal to the gross non-current assets (FA) account (which records the acquisition cost of non-current assets) minus the accumulated depreciation (AD) account (which records the total depreciation taken by the firm against its non-current assets). Using the fact that NFA = FA − AD, show that the expression given in the chapter for net capital spending, NFAend − NFAbeg + D (where D is the depreciation expense during the year), is equivalent to FAend − FAbeg.

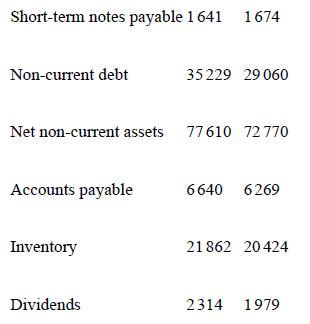

Use the following information for Taco Swell Limited for Problems 21 and 22 (assume the tax rate is 30 per cent):

Step by Step Answer:

Fundamentals Of Corporate Finance

ISBN: 9781743768051

8th Edition

Authors: Stephen A. Ross, Rowan Trayler, Charles Koh, Gerhard Hambusch, Kristoffer Glover, Randolph W. Westerfield, Bradford D. Jordan