1. 22. Abandonment decisions [LO 24.5] Consider the following project of Hand Clapper Limited. The company is...

Question:

1. 22.

Abandonment decisions [LO 24.5] Consider the following project of Hand Clapper Limited. The company is considering a four-year project to manufacture clap-command garage door openers. This project requires an initial investment of $14 million that will be depreciated straight-line to zero over the project’s life. An initial investment in net working capital of

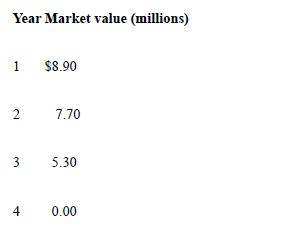

$900 000 is required to support spare parts inventory; this cost is fully recoverable whenever the project ends. The company believes it can generate $10.1 million in pretax revenue with $3.8 million in total pretax operating expenses. The tax rate is 30 per cent and the discount rate is 13 per cent. The market value of the equipment over the life of the project is as follows:

1. Assuming the company operates this project for four years, what is the NPV?

2. Now compute the project NPV assuming the project is abandoned after only one year, after two years and after three years. What economic life for this project maximises its value to the firm? What does this problem tell you about not considering abandonment possibilities when evaluating projects?

Step by Step Answer:

Fundamentals Of Corporate Finance

ISBN: 9781743768051

8th Edition

Authors: Stephen A. Ross, Rowan Trayler, Charles Koh, Gerhard Hambusch, Kristoffer Glover, Randolph W. Westerfield, Bradford D. Jordan