7. 17. Using the SML [LO 13.4] Asset W has an expected return of 11.8 per cent...

Question:

7. 17.

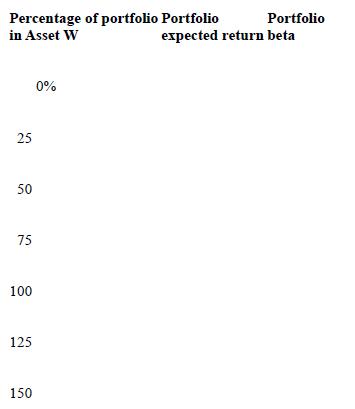

Using the SML [LO 13.4] Asset W has an expected return of 11.8 per cent and a beta of 1.10. If the risk-free rate is 3.3 per cent, complete the following table for portfolios of Asset W and a risk-free asset.

Illustrate the relationship between portfolio expected return and portfolio beta by populating the table below with the expected returns against the betas. What is the slope of the line that results?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9781743768051

8th Edition

Authors: Stephen A. Ross, Rowan Trayler, Charles Koh, Gerhard Hambusch, Kristoffer Glover, Randolph W. Westerfield, Bradford D. Jordan

Question Posted: