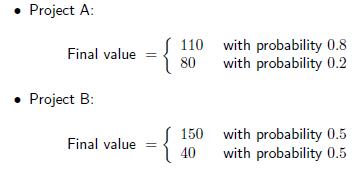

A start-up company considers two investment projects that require a $90 investment. Both are zero NPV projects

Question:

A start-up company considers two investment projects that require a $90 investment. Both are zero NPV projects

(hence, the value of the project is $90). Only one project can be implemented. Part of the necessary funds are to be acquired through a zero-coupon debt issue, with face value of $85. The remainder is collected through an equity issue. The specifics of the two projects are

1. Which project has the highest expected return?

2. Assume management randomly picks a project, and decides to choose Project A. (Management should not have any particular preference, because both projects have a zero NPV.) How much money will the company raise from the debt issue? How much equity will be raised? Assume that the risk free interest rate equals 5%.

3. Assume now that the debt and equity issues to finance project A have been completed. Now the management turns around and does not implement project A, but, instead, goes ahead with project B. What is the loss in value to the debtholders? Would the equity holders applaud this move?

4. If the bondholders expect management to pick projects in the interest of shareholders, under which terms will bondholders finance project A?

Step by Step Answer:

Lectures On Corporate Finance

ISBN: 9789812568991

2nd Edition

Authors: Peter L Bossaerts, Bernt Arne Odegaard