The financial statements at the end of Atlas Realtys first month of operations follow: Instructions By analyzing

Question:

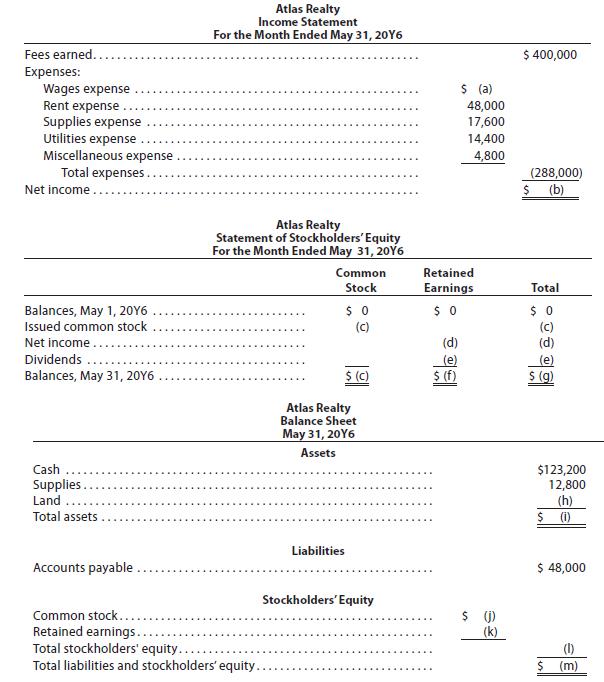

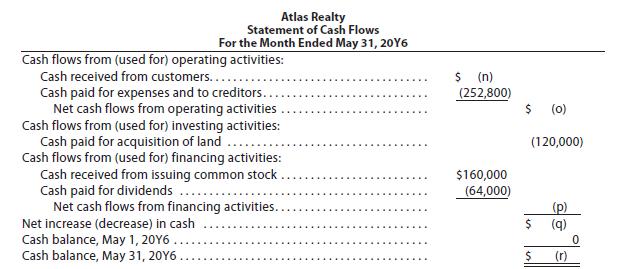

The financial statements at the end of Atlas Realty’s first month of operations follow:

Instructions

By analyzing the interrelationships among the four financial statements, determine the proper amounts for (a) through (r).

Transcribed Image Text:

Atlas Realty Income Statement For the Month Ended May 31, 20Y6 Fees earned.. $ 400,000 Expenses: Wages expense Rent expense $ (a) 48,000 17,600 Supplies expense Utilities expense Miscellaneous expense Total expenses. 14,400 4,800 (288,000) $ (b) Net income .... Atlas Realty Statement of Stockholders' Equity For the Month Ended May 31, 20Y6 Common Retained Stock Earnings Total $ 0 Balances, May 1, 20Y6 Issued common stock $ 0 (c) (d) (c) Net income . (d) Dividends (e) (e) Balances, May 31, 20Y6 $ (C) $ (f) S (g) Atlas Realty Balance Sheet May 31, 20Y6 Assets Cash $123,200 12,800 (h) $ (i) Supplies. Land ... Total assets Liabilities Accounts payable $ 48,000 Stockholders' Equity $ () (k) Common stock.. Retained earnings. Total stockholders' equity... Total liabilities and stockholders' equity. (1) (m)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 62% (8 reviews)

a Wages expense 203200 288000 48000 17600 14400 4800 b Net income 112000 400000 288000 c Common stoc...View the full answer

Answered By

Keziah Thiga

I am a self motivated financial professional knowledgeable in; preparation of financial reports, reconciling and managing accounts, maintaining cash flows, budgets, among other financial reports. I possess strong analytical skills with high attention to detail and accuracy. I am able to act quickly and effectively when dealing with challenging situations. I have the ability to form positive relationships with colleagues and I believe that team work is great key to performance. I always deliver quality, detailed, original (0% plagirism), well-researched and critically analyzed papers.

4.90+

1504+ Reviews

2898+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The financial statements at the end of Sciatic Realty, Inc.s first month of operation are shown below. By analyzing the interrelationships between the financial statements, fill in the proper amounts...

-

The financial statements at the end of Flagstone Consulting, Inc.s first month of operation are shown below. By analyzing the interrelationships between the financial statements, fill in the proper...

-

The financial statements at the end of Sayre Realty, Inc.s first month of operation are shown below. By analyzing the interrelationships among the financial statements, fill in the proper amounts for...

-

Consider a cube that has 5cm length sides. What is the surface area to volume ratio of this cube? Report your answer in cm/cm Report your answer to one decimal place. QUESTION 12 Consider a cube that...

-

List 5 to 10 effects of changing climate.

-

Metal Corporation acquired 75 percent ownership of Ocean Company on January 1, 20X1, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 25 percent of...

-

The two quotes below were taken from The Wall Street Journal. A month after he staved offfinancial ruin by getting his bankers to lend him $65 million, Donald Trump is about to ask his casino...

-

A debt of $5000 can be repaid, with interest at 8%, by the following payments. Year Payment 1 $ 500 2 1000 3 1500 4 2000 5 X The payment at the end of the fifth year is shown as X. How much is X?

-

Which of the following statements is TRUE? A None of the above ) KPI and KRI can only be leading indicators ( GRC is just a compliance program D) GRC stands for government, risk, and control

-

You have created a not-for-profit hospital and are recording the transactions for the first year. Here are the first 29 recorded transactions: Transactions for the year 2019: 1.) Jan 1st The hospital...

-

A summary of cash flows for A-One Travel Service for the year ended August 31, 20Y6, follows: The cash balance as of September 1, 20Y5, was $59,500. Prepare a statement of cash flows for A-One Travel...

-

Determine the missing amount for each of the following: + Stockholders' Equity $875,000 Assets Liabilities a. X $1,200,000 + b. $3,860,000 C $71,850,000 X $900,000 $59,100,000 + X

-

Obtain the Thevenin equivalent seen at terminals a-b of the circuit in Fig. 4.130? 1S2 4 2 104 < o b

-

Define subjective brightness and brightness adaptation?

-

Write Down The Properties Of Haar Transform?

-

Explain Spatial Filtering?

-

What Is Maximum Filter And Minimum Filter?

-

Name The Categories Of Image Enhancement And Explain?

-

Perine, Inc., has balance sheet equity of $6.8 million. At the same time, the income statement shows net income of $815,000. The company paid dividends of $285,000 and has 245,000 shares of stock...

-

Explain the operation of the dividends received deduction.

-

Convert each of the following estimates of useful life to a straight-line depreciation rate, stated as a percentage, assuming that the residual value of the fixed asset is to be ignored: (a) 2 years,...

-

Equipment was acquired at the beginning of the year at a cost of $324,000. The equipment was depreciated using the double-declining-balance method based on an estimated useful life of eight years and...

-

A stockbroker advises a client to buy preferred stock. . . . With that type of stock, . . . [you] will never have to worry about losing the dividends. Is the broker right?

-

3 . Accounting.. How does depreciation impact financial statements, and what are the different methods of depreciation?

-

NEED THIS EXCEL TABLE ASAP PLEASE!!!! Presupuesto Operacional y C lculo del COGS Ventas Proyectadas: Ventas Proyectadas: $ 4 5 0 , 0 0 0 Precio por unidad: $ 4 5 0 Unidades vendidas: 4 5 0 , 0 0 0 4...

-

The wash sale rules apply to disallow a loss on a sale of securities_______? Only when the taxpayer acquires substantially identical securities within 30 days before the sale Only when the taxpayer...

Study smarter with the SolutionInn App