Reconciling numbers to US GAAP: effect on profitability and leverage Helping Hand is a business services firm

Question:

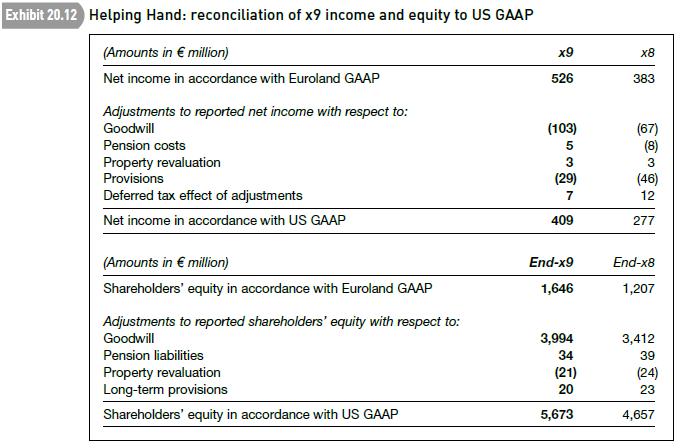

Reconciling numbers to US GAAP: effect on profitability and leverage Helping Hand is a business services firm that specialises in outsourcing services. Although based in a eurozone country – we’ll call it Euroland, it has acquired businesses in other countries in recent years. Because of its growing international profile, it obtains permission to list its shares on the New York Stock Exchange. The company prepares its published accounts according to Euroland GAAP but provides a reconciliation of net income and shareholders’ equity to US GAAP, as required by SEC regulations. The reconciliation given in its x9 accounts is set out in Exhibit 20.12.

Euroland GAAP differs from US GAAP in several important respects.

l Prior to x9, Euroland companies could write off purchased goodwill against reserves. Since the start of x9, they must capitalise and amortise it.

l Euroland rules for establishing provisions – for restructuring and other costs – are less strict than US ones so Euroland companies can set them up at an earlier date than US firms can.

l Euroland companies are permitted to revalue tangible fixed assets. Depreciation is calculated on the revalued amount of the assets. The revaluation surplus is credited to a non-distributable reserve and can be transferred to distributable reserves only when realised. US GAAP does not permit such asset revaluations.

l In estimating the cost of their defined benefit pension plans, Euroland and US companies use different actuarial methods.

Required

(a) Calculate Helping Hand’s ROE for x9 under both Euroland and US GAAP. Clearly, goodwill is responsible for the large difference in reported profitability under the two accounting regimes.

Why does Helping Hand deduct an amount for goodwill in arriving at US GAAP income but add a much larger amount under the same heading in arriving at US GAAP shareholders’ equity?

(b) A condensed version of Helping Hand end-x9 balance sheet is set out below. It is prepared according to Euroland GAAP. Amounts are in A million.

Assets Fixed assets 6,404 Current assets other than cash 3,099 Cash and cash equivalents 497 Total assets 10,000

Shareholders’ equity and liabilities Shareholders’ equity 1,646 Minority interests 235 Debt (including financial lease commitments) 4,178 Provisions and other long-term operating liabilities 761 Current operating liabilities 3,180 Total shareholders’ equity and liabilities 10,000 (i) Using information in Exhibit 20.12, adjust the above balance sheet figures to (approximate) US GAAP.

(ii) Calculate Helping Hand’s end-x9 net debt-to-group equity ratio under both Euroland and US GAAP.

(iii) On seeing your answers to (ii), an analyst remarks: ‘No wonder the market has moved to cash flow measures of financial leverage. Balance sheet measures of leverage give absurd results.’ What is the point the analyst is making? Under what circumstances do balance sheet measures of leverage give ‘absurd results’?AppenedixLO1

Step by Step Answer: