Eastmed, Inc., has a number of divisions, including Aberdeen Division, producer of surgical blades, and Fairfield Division,

Question:

Eastmed, Inc., has a number of divisions, including Aberdeen Division, producer of surgical blades, and Fairfield Division, a manufacturer of medical instruments.

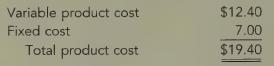

Aberdeen Division produces a 2.6 cm steel blade that can be used by Fairfield Division in the production of scalpels. The market price of the blade is $22.60. Cost information for the blade is:

Fairfield needs 15,000 units of the 2.6 cm blade per year. Aberdeen Division is at full capacity (90,000 units of the blade).

Required:

1. If Eastmed, Inc., has a transfer pricing policy that requires transfer at market price, what would the transfer price be? Do you suppose that Aberdeen and Fairfield divisions would choose to transfer at that price?

2. Now suppose that Eastmed, Inc., allows negotiated transfer pricing and that Aberdeen Division can avoid $1.75 of selling and distribution expense by selling to Fairfield Division. Which division sets the minimum transfer price, and what is it? Which division sets the maximum transfer price, and what is it? Do you suppose that Aberdeen and Fairfield divisions would choose to transfer somewhere in the bargaining range?

3. What if Aberdeen Division plans to produce and sell only 65,000 units of the 2.6 cm blade next year? Which division sets the minimum transfer price, and what is it?

Which division sets the maximum transfer price, and what is it? Do you suppose that Aberdeen and Fairfield divisions would choose to transfer somewhere in the bargaining range?LO1

Step by Step Answer:

Introduction To Cost Accounting

ISBN: 9780538749633

1st International Edition

Authors: Don R. Hansen, Maryanne Mowen, Liming Guan, Mowen/Hansen