(Payback; IRR) Alleys Accounting Service prepares tax returns for individuals and small businesses. The firm employs four...

Question:

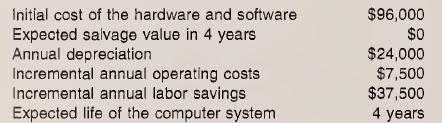

(Payback; IRR) Alley’s Accounting Service prepares tax returns for individuals and small businesses. The firm employs four tax professionals. Currently, all tax returns are prepared on a manual basis. The firm’s owner, Anne Alley, is considering purchasing a computer system that would allow the firm to ser¬ vice all its existing clients with only three employees. To evaluate the feasi¬ bility of the computerized system, Alley has gathered the following information;

Alley has determined that she will invest in the computer system if its pre¬ tax payback period is less than 3.5 years and its pre-tax IRR exceeds 12 percent.

a. Compute the payback period for this investment. Does the payback meet Alley’s criterion? Explain.

b. Compute the IRR for this project to the nearest percent. Based on the computed IRR, is this project acceptable to Alley?

C. What qualitative factors should Alley consider in evaluating the project? LO.1

Step by Step Answer:

Cost Accounting Foundations And Evolutions

ISBN: 9780324235012

6th Edition

Authors: Michael R. Kinney, Jenice Prather-Kinsey, Cecily A. Raiborn