(Retail merchant CVP) Baker Optical Shop has been in operation for several years. Analysis of the firms...

Question:

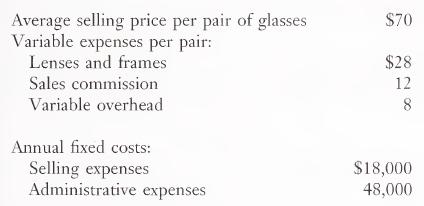

(Retail merchant CVP) Baker Optical Shop has been in operation for several years. Analysis of the firm’s recent financial statements and records reveal the following:

The company’s effective tax rate is 40 percent. Sara Baker, company president, has asked you to help her answer the following questions about the business.

a. What is the break-even point in pairs of glasses? In dollars?

b. How much revenue must be generated to produce $80,000 of pretax earn¬ ings? How many pairs of glasses would this level of revenue represent?

c. How much revenue must be generated to produce $80,000 of after-tax earn¬ ings? How many pairs of glasses would this represent?

d. What amount of revenue would be necessary to yield an after-tax profit equal to 20 percent of revenue?

e. Baker is considering adding a lens-grinding lab, which will save $6 per pair of glasses in lens cost, but will raise annual fixed costs by $8,000. She expects to sell 5,000 pairs of glasses. Should she make this investment?

f. A marketing consultant told Baker that she could increase the number of glasses sold by 30 percent if she would lower the selling price by 10 percent and spend $20,000 on advertising. She has been selling 3,000 pairs of glasses. Should she make these two related changes?LO1

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780538880473

3rd Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney