A new subsidiary of a group of companies was established for the manufacture and sale of Product

Question:

A new subsidiary of a group of companies was established for the manufacture and sale of Product X. During the first year of operations 90,000 units were sold at £20 per unit. At the end of the year, the closing stocks were 8,000 units in finished goods store and 4,000 units in work-in-progress which were complete as ragards material content but only half complete in respect of labour and overheads.

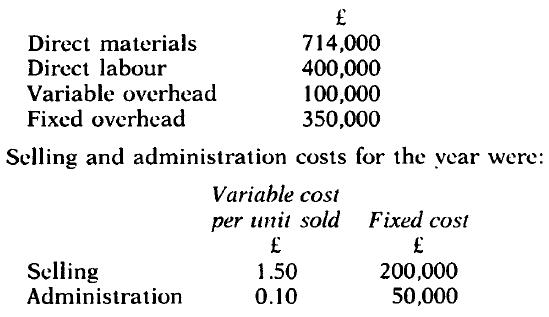

You are to assume that there were no opening stocks. The work-inprogress account had been debited during the year with the following costs:

The accountant of the subsidiary company had prepared a profit statement on the absorption costing principle which showed a profit of £11,000. The financial controller of the group, however, had prepared a profit statement on a marginal costing basis which showed a loss. Faced with these two profit statements, the director responsible for this particular subsidiary company is confused.

You are required to

(a) Prepare a statement showing the equivalent units produced and the production cost of one unit of Product X by element of cost and in total.

(b) Prepare a profit statement on the absorption costing principle which agrees with the company accountant's statement.

(c) Prepare a profit statement on the marginal costing basis.

(d) Explain the differences between the two statements given for (b) and (c) above to the director in such a way as to eliminate his confusion and stale why both statements may be acceptable.

Step by Step Answer: