Analyzing and justifying cost allocation variables Bonn Company recently reor- ganized its computer and data processing activities.

Question:

Analyzing and justifying cost allocation variables Bonn Company recently reor- ganized its computer and data processing activities. The small installations located within the accounting departments at its plants and subsidiaries have been replaced with a single data processing department at corporate headquarters responsible for the operations of a newly acquired large-scale computer system. The new department has been in operation for 2 years and has been regularly producing reliable and timely data for the past 12 months.

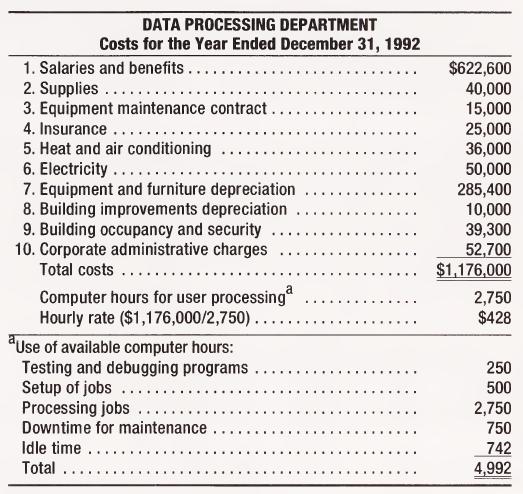

Because the department has focused its activities on converting applications to the new system and producing reports for the plant and subsidiary managements, little attention has been devoted to the costs of the department. Now that the department's activities are operating relatively smoothly, company management has requested that the departmental manager recom- mend a cost accumulation system to facilitate cost control and the development of suitable rates to charge users for service. For the past 2 years, the department costs have been recorded in one account. The costs have then been allocated to user departments on the basis of computer time used. The following schedule reports the costs and charging rate for 1992.

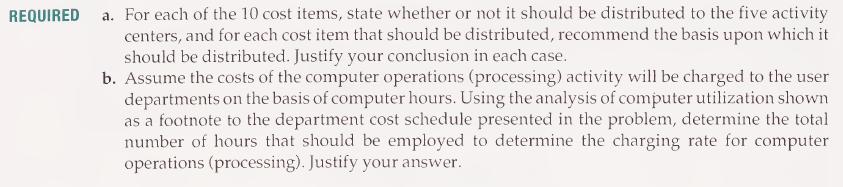

The department manager recommends that the department costs be accumulated by five activity centers within the department: systems analysis, programming, data preparation, com- puter operations (processing), and administration. He then suggests that the costs of the administration activity should be allocated to the other four activity centers before a separate rate for charging users is developed for each of the first four activities.

The manager made the following observations regarding the charges to the several subsid- iary accounts within the department after reviewing the details of the accounts:

1. Salaries and benefits—records the salary and benefit costs of all employees in the department.

2. Supplies—records punch card costs, paper costs for printers, and a small amount for miscella- neous other costs.

3. Equipment maintenance contracts—records charges for maintenance contracts; all equipment is covered by maintenance contracts.

4. Insurance—records cost of insurance covering the equipment and the furniture.

5. Heat and air conditioning—records a charge from the corporate heating and air-conditioning department estimated to be the incremental costs to meet the special needs of the computer department.

6. Electricity—records the charge for electricity based upon a separate meter within the depart- ment.

7. Equipment and furniture depreciation—records the depreciation charges for all owned equip- ment and furniture within the department.

8. Building improvements—records the amortization charges for the building, changes re- quired to provide proper environmental control, and electrical service for the computer equipment.

9. Building occupancy and security—records the computer department's share of the depreci- ation, maintenance, heat, anci security costs of the building;dhese costs are allocated to the department on the basis of square feet occupied.

10.Corporate administrative charges—records the computer department's share of the corpo- rate administrative costs. They are allocated to the department- on the basis of number of employees in the department.

Step by Step Answer: