Direct, step-down and reciprocal allocations Ankara Chair Manufacturing Inc., has three service departments. Manufacturing Cost Accounting (Accounting),

Question:

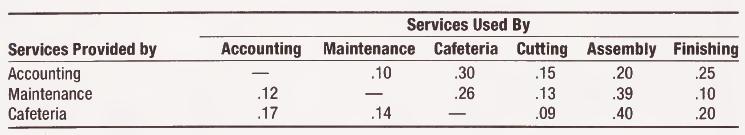

Direct, step-down and reciprocal allocations Ankara Chair Manufacturing Inc., has three service departments. Manufacturing Cost Accounting (Accounting), Maintenance, and Factory Cafeteria (Cafeteria) serving three production departments. Cutting, Assembly and Finishing. The percentage use of each service department by others are provided below:

Last year. Accounting incurred $10,000 total costs that are directly traceable to this depart- ment including salaries, office supplies expense and computer costs. Maintenance incurred a total of $12,000 in costs that are directly traceable to this department. Cafeteria has total costs of $18,000 which include wages of cooks and other cafeteria workers as well as material costs of the food prepared.

Cutting has incurred departmental overhead costs of $100,000 last year. The total overhead costs in the Assembly department were $200,000 and Finishing has a total of $150,000 in total costs that were identified as departmental overhead.

REQUIRED

a. Allocate service department costs to the three producing departments using the direct alloca- tion method.

b. Using the step-down method of allocation calculate the total overhead costs in each producing department. The service department providing the most services to other service departments is allocated first followed by the next broadest based department.

Computer requirement

c. Using the reciprocal relationships between the service departments calculate the total over- head costs for the producing departments.

Step by Step Answer: