Making journal entries to record the cost and the sale of a by-product. The Republic Company has

Question:

Making journal entries to record the cost and the sale of a by-product. The Republic Company has three producing departments: the Grinding Department, the Mixing Department, and the Packaging Department. Five percent of the raw materials put into production in the Grinding Department become a by-product that has an estimated sales value of $.06 per kilogram. The estimated sales value of the by-product is treated as a reduction in the cost of the main product. During November 19X3, 500,000 kilograms are put into production.

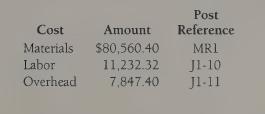

There are no beginning and ending inventories. During November 19X3, the following costs are incurred in the Grinding Department:

Instructions 1. Enter the materials, labor, and overhead costs in the Work in Process—Grinding Department account. Open the Inventory of By-Product account.

2. Prepare the general journal voucher to record the removal of the by-product from the Grinding Department. Number the voucher 11-12. Post the voucher to the general ledger accounts opened.

3. Prepare the general journal voucher to record the sale of half the by-product inventory for $776.45 cash. Number the voucher 11-13. Use the same account names and numbers that are used in the text. Post the voucher to the Inventory of By-Product account.

Step by Step Answer:

Cost Accounting Principles And Applications

ISBN: 9780070081529

5th Edition

Authors: Horace R. Brock