Manufacturing costs and income statement for a small business The Wilsons use shells, driftwood, and other items

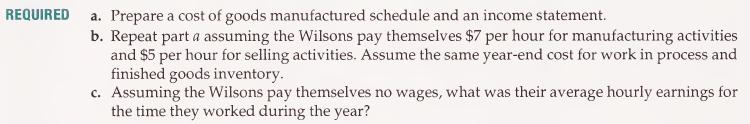

Question:

Manufacturing costs and income statement for a small business The Wilsons use shells, driftwood, and other items from the beach and make decorative art forms of various types. After much evaluation, they decided to move to the Gulf coast of Florida and open a shop where they will make and sell their art work. The Wilsons started their business, called Beach Art, in January and the following transactions and events occurred.

January 5: Invested $50,000 in the new business.

January 6: Leased a shop for $15,000 per year. Sixty percent of the building space is used for producing art works and 40 percent is used for sales space.

January 8: Purchased various production equipment for $12,000 cash. The equipment has a useful life of 5 years with no salvage value. Straight-line depreciation is used.

January 15: Purchased cash register, display cases, and other sales and administrative equipment costing $35,000, paying $5,000 down and giving a $30,000 note payable. The salvage value of the equipment is estimated as $5,000 is 6 years.

During the rest of the calendar year: Manufacturing supplies costing $28,000 were purchased. Of- fice supplies costing $1,400 were purchased. Utilities expenses of $2,500 were paid. Insurance expenses were $3,000 for the year. Property taxes were $1,500. Part-time sales help cost $4,200. Part-time manufacturing labor was $3,100. Sales totaled $85,100.

At year-end: Office supplies of $600 were on hand. Manufacturing supplies inventory was $4,600. Finished goods inventory at cost was $5,100. Ending work in process on December 31 cost $2,200.

During the year, Mr. Wilson worked 1,600 hours and Mrs. Wilson worked 1,900 hours. They estimated that Mr. Wilson's time was spent 60 percent selling and 40 percent manufacturing products. Mrs. Wilson's time was spent 30 percent selling and 70 percent manufacturing.

Step by Step Answer: