Income statement for a merchandising business Mary Waltz has been a comic book col- lector for many

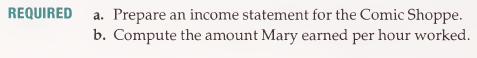

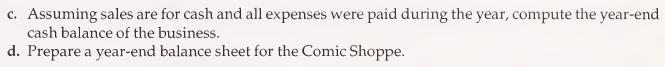

Question:

Income statement for a merchandising business Mary Waltz has been a comic book col- lector for many years and recently decided to use her hobby to supplement the income from her regular job as a telephone installer. On April 1 she rented a small shop on Main Street for $210 per month and invested $2,500 cash and $12,000 of comic books as inventory to open the Comic Shoppe. On April 2 she purchased a $3,500 cash register with a $1,000 down payment and a note payable for the balance. The cash register has a five year useful life and $500 salvage value.

During the rest of the calendar year the following occurred: Purchased supplies costing $760. Comic book sales totaled $31,700. Purchased comics costing $14,200. Paid $7,900 in salaries to sales help when Mary is working at her regular job. Incurred advertising expense of $550. Paid utility bills of $1,180. Mary worked 798 hours at the shop. Paid $900 for a one-year fire insurance policy starting on August 1. At year end, supplies inventory is $290 and comic book inventory at cost is $13,300.

Step by Step Answer: