Uniform cash flows with salvage value After working several years as a corporate pilot, Jim Largo saved

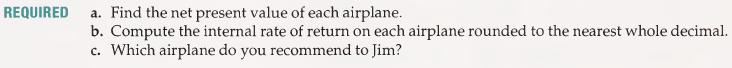

Question:

Uniform cash flows with salvage value After working several years as a corporate pilot, Jim Largo saved enough money to buy a used airplane and start the Largo Air Charter Service. He has found two airplanes that would meet his needs and are within his price range.

The first airplane is a twin Spinwell Bison with an asking price of $96,250. Jim estimates that the airplane has a useful life of 12 years and a salvage value of $16,000. The second airplane is a twin Stallmore Shotput with an asking price of $86,975. This airplane is somewhat older, and Jim estimates it has a useful life of 10 years and a salvage value of $15,000.

Operating costs for both airplanes are similar. If Jim charges competitive rates, he estimates that his net cash inflow from operating the charter service will be $18,000 per year. Jim feels that starting a charter service is feasible only if he can earn a minimum 14 percent return on his airplane investments.

Step by Step Answer: