Cost of capital and project evaluation Wormling Company operates several sheet metal fabricating shops. It is capitalized

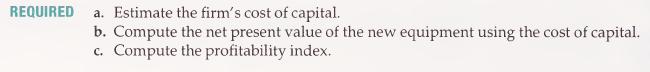

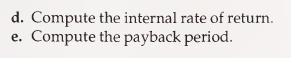

Question:

Cost of capital and project evaluation Wormling Company operates several sheet metal fabricating shops. It is capitalized with the following securities:

□ $500,000 of 12% bonds trading in the market at 80

□ 60,000 shares, $100 par $7 preferred stock trading at $50 per share

□ 20,000 shares, $2 par common stock trading at $25 per share The company is subject to a 40 percent income tax rate. It pays $4.50 of cash dividends on its common stock annually. It is planning to acquire a new sheet metal brake for one of its shops. The equipment costs $75,550 and has a useful life of 8 years and no salvage value. Cost savings from operating the new equipment are estimated at $17,000 per year.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: