A company manufactures two products P1 and P2 in a factory divided into two cost centres, X

Question:

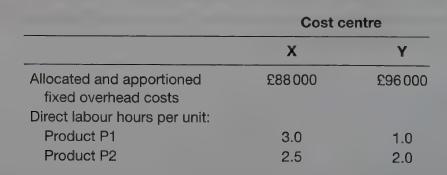

A company manufactures two products P1 and P2 in a factory divided into two cost centres, X and Y. The following budgeted data are available:

Budgeting output is 8000 units of each product. Fixed overhead costs are absorbed on a direct labour hour basis.

What is the budgeted fixed overhead cost per unit for Product P2?

(a) £10

(b) £11

(c) £12

(d) £13 (2 marks)

CIMA P17 Performance Operations

Transcribed Image Text:

Allocated and apportioned fixed overhead costs Direct labour hours per unit: Product P1 Product P2 Cost centre X Y 88000 96000 3.0 1.0 2.5 2.0

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Change in Study Design or Results The t statistic A switch from using a two-tailed test to a one-tailed test An increase in the sample variance (s) A decrease in the significance level (such as using...

-

Please help me with the following listed below. Thank you in advance. FINANCIAL AND MANAGERIAL ACCOUNTING - Fifth Edition E25-10 Requirements 1. Prepare a differential analysis to determine whether...

-

uestion: 1. IN A STOCK ACQUISITION ACCOUNTED FOR BY THE EQUITY METHOD, A PORTION OF THE PURCHASE PRICE OFTEN IS ATTRIBUTABLE TO GOODWILL OR TO SPECIFIC ASSETS OR LIABILITIES. HOW OR UNDER WHAT BASIS...

-

In a two-player, one-shot simultaneous-move game each player can choose strategy A or strategy B. If both players choose strategy A, each earns a payoff of $500. If both players choose strategy B,...

-

What is a minimum wage and what are its effects if it is set above the equilibrium wage?

-

We William works for filichardson Commy at year and cams a morthly salary of 1.200 There has vertime pay Bured on Jumala 4, Richarhan the came to Booths posa poy Mey 21 Sumut tad 529.400 of Click the...

-

Figure 20.35 shows a thin, uniformly charged disk of radius R. Imagine the disk divided into rings of varying radii r, as suggested in the figure. (a) Show that the area of such a ring is very...

-

Complete the chart below, indicating the Calvet Trusts entity accounting income for each of the alternatives. For this purpose, use the following information. Interest income, taxable Interest...

-

A 3-year bond carrying 3.4% annual coupon and $100-par is putable at par 1 year and 2 years from today. Calculate the value of the putable bond under the forward rate curve below. 1-year spot rate:...

-

A company manufactures and sells one product which requires 8kg of raw material in its manufacture. The budgeted data relating to the next period are as follows: What is the budgeted raw material...

-

The following estimates have been prepared for a retailers next budget period: The gross profit margin on sales is budgeted at 55 per cent. (a) The cash which the retailer expects to receive from...

-

Complete the requirements for the module, ``Listening to the Earth: Controlled Source Seismology,'' by Richard G . Montgomery, UMAP 292-293. This module develops the elementary theory of wave...

-

Revenue and cash receipts journals; accounts receivable subsidiary and general ledgers Transactions related to revenue and cash receipts completed by Crowne Business Services Co. during the period...

-

Panguitch Company had sales for the year of $100,000. Expenses (except for income taxes) for the year totaled $80,000. Of this $80,000 in expenses, $10,000 is bad debt expense. The tax rules...

-

Assume that the composition of federal outlays and receipts shown in the figure remained the same in 2019. In the figure, the categories "Defense and homeland security" and "Non-defense...

-

1) A car's age is a _ variable. Quantitative O Categorical 2) A car's maker is a variable O Quantitative Categorical 3) A house's square footage is a _________variable O Quantitative O Categorical 4)...

-

The following table shows the distribution of clients by age limits. Use the grouped data formulas to calculate the variance and standard deviation of the ages. Rango de edad Cantidad de clientes...

-

Iron River Company, an electronics repair store, prepared the unadjusted trial balance at the end of its first year of operations shown below. For preparing the adjusting entries, the following data...

-

The water in tank A is at 270 F with quality of 10% and mass 1 lbm. It is connected to a piston/cylinder holding constant pressure of 40 psia initially with 1 lbm water at 700 F. The valve is opened,...

-

A project with an initial cost of $32,000 is expected to provide cash flows of $12,900, $13,100, $16,200, and $10,700 over the next four years, respectively. If the required return is 8.1 percent,...

-

A company that is expecting to receive EUR 500,000 in 60 days is considering entering into an FX futures contract to lock an exchange rate to USD for the transaction. The FX rate on the contract is...

-

Suppose you bought a bon with an annual coupon rate of 6.5 percent one year ago for $1,032. The bond sells for $1,020 today. a. Assuming a $1,000 face value, what was your total dollar return on this...

Study smarter with the SolutionInn App