Calculation of labour, material and overhead variances plus appropriate accounting entries JC Limited produces and sells one

Question:

Calculation of labour, material and overhead variances plus appropriate accounting entries JC Limited produces and sells one product only, Product J, the standard cost for which is as follows for one unit.

The fixed production overhead is based on an expected annual output of 10800 units produced at an even flow throughout the year; assume each calendar month is equal. Fixed production overhead is absorbed on direct labour hours.

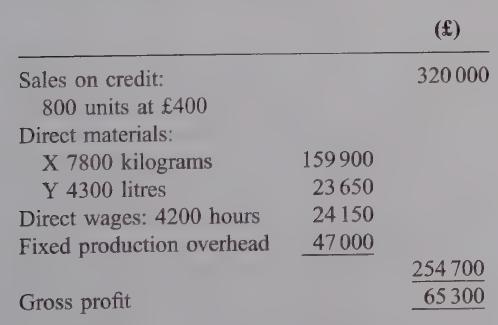

During April, the first month of the financial year, the following were the actual results for an actual production of 800 units.

The material price variance is extracted at the time of receipt and the raw materials stores control is maintained at standard prices. The purchases, bought on credit, during the month of April were:

You are required to

(a) (i) calculate price and usage variances for each material, (ii) calculate labour rate and efficiency variances, (iii) calculate fixed production overhead expenditure, efficiency and volume variances; (9 marks)

(b) show all the accounting entries in T accounts for the month of April — the work-in-progress account should be maintained at standard cost and each balance on the separate variance accounts is to be transferred to a Profit and Loss Account which you are also required to show; (18 marks)

(c) explain the reason for the difference between the actual gross profit given in the question and the profit shown in your profit and loss account.

Step by Step Answer: