Calculation of overhead absorption rates and under-/over-recovery of overheads A manufacturing company has two production cost centres

Question:

Calculation of overhead absorption rates and under-/over-recovery of overheads A manufacturing company has two production cost centres (Departments A and B) and one service cost centre (Department C) in its factory. A predetermined overhead absorption rate (to two decimal places of £) is established for each of the production cost centres on the basis of budgeted overheads and budgeted machine hours.

The overheads of each production cost centre comprise directly allocated costs and a share of the costs of the service cost centre.

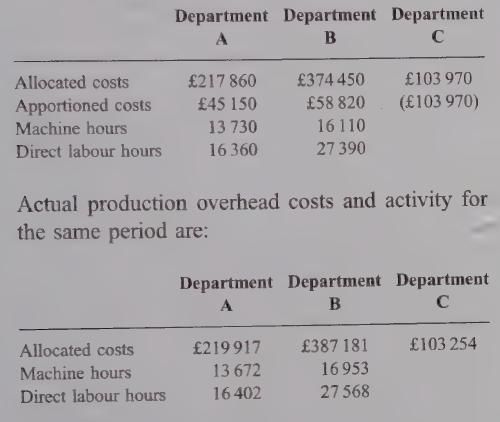

Budgeted production overhead data for a period is as follows:

70% of the actual costs of Department C are to be apportioned to production cost centres on the basis of actual machine hours worked and the remainder on the basis of actual direct labour hours.

Required:

(a) Establish the production overhead absorption rates for the period. (3 marks)

(b) Determine the under- or over-absorption of production overhead for the period in each production cost centre. (Show workings clearly.) (12 marks)

(c) Explain when, and how, the repeated distribution method may be applied in the overhead apportionment process.

Step by Step Answer: