Interlocking accounts CD Ltd, a company engaged in the manufacture of specialist marine engines, operates a historic

Question:

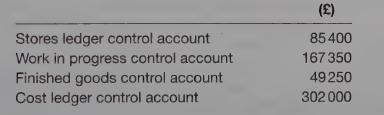

Interlocking accounts CD Ltd, a company engaged in the manufacture of specialist marine engines, operates a historic job cost accounting system that is not integrated with the financial accounts. At the beginning of May the opening balances in the cost ledger were as follows:

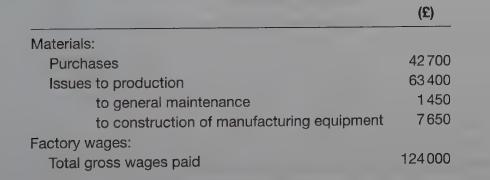

During the month, the following transactions took place:

£12500 of the above gross wages was incurred on the construction of manufacturing equipment, £35 750 was indirect wages and the balance was direct.

Production overheads: the actual amount incurred, excluding items shown above, was £152350; £30000 was absorbed by the manufacturing equipment under construction and under-absorbed overhead written off at the end of the month amounted to £7550.

Royalty payments: one of the engines produced is manufactured under licence.

£2150 is the amount that will be paid'to the inventor for the month’s production of that particular engine.

Selling overheads: £22000.

Sales: £410 000.

The company’s gross profit margin is 25 per cent on factory cost.

At the end of May stocks of work in progress had increased by £12000. The manufacturing equipment under construction was completed within the month, and transferred out of the cost ledger at the end of the month.

Required:

Prepare the relevant control accounts, costing profit and loss account, and any other accounts you consider necessary to record the above transactions in the cost ledger for May.

(22 marks)

ACCA Foundation Costing

Step by Step Answer: