Losses in process and weighted averages method ABC ple operates an integrated cost accounting system and has

Question:

Losses in process and weighted averages method ABC ple operates an integrated cost accounting system and has a financial year which ends on 30 September. It operates in a processing industry in which a single product is produced by passing inputs through two sequential processes. A normal loss of 10% of input is expected in each process.

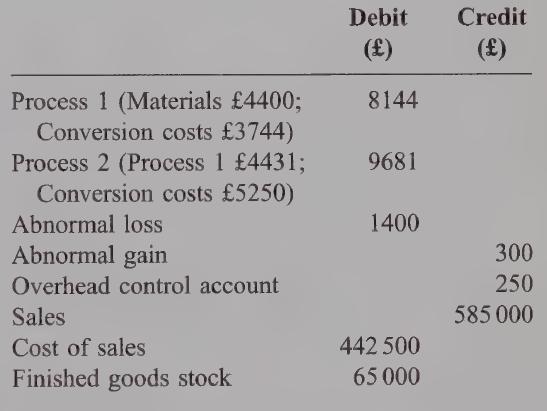

The following account balances have been extracted from its ledger at 31 August:

ABC ple uses the weighted average method of accounting for work in process.

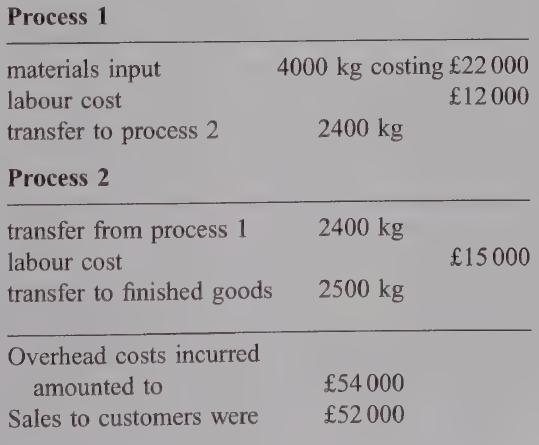

During September the following transactions occurred:

Overhead costs are absorbed into process costs on the basis of 150% of labour cost.

The losses which arise in process 1 have no scrap value: those arising in process 2 can be sold for £2 per kg.

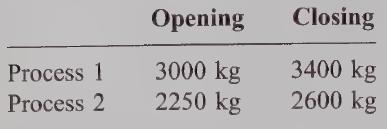

Details of opening and closing work in process for the month of September are as follows:

In both processes closing work in process is fully complete as to material cost and 40% complete as to conversion cost.

Stocks of finished goods at 30 September were valued at cost of £60000.

Required:

Prepare the ledger accounts for September and the annual proft and loss account of ABC plc. (Commence with the balances given above, balance off and transfer any balances as appropriate.)

Step by Step Answer: