Preparation of variable and absorption costing profit statements and an explanation of the change in profits A

Question:

Preparation of variable and absorption costing profit statements and an explanation of the change in profits A company sells a single product at a price of £14 per unit. Variable manufacturing costs of the product are £6.40 per unit. Fixed manufacturing overheads, which are absorbed into the cost of

"production at a unit rate (based on normal activity of 20 000 units per period), are £92 000 per period.

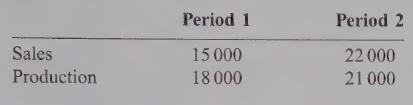

Any over- or under-absorbed fixed manufacturing overhead balances are transferred to the profit and loss account at the end of each period, in order to establish the manufacturing profit. Sales and production (in units) for two periods are as follows:

The manufacturing profit in Period 1 was reported as £35 800.

Required:

(a) Prepare a trading statement to identify the manufacturing profit for Period 2 using the existing absorption costing method.

(7 marks)

(b) Determine the manufacturing profit that would be reported in Period 2 if marginal costing was used. (4 marks)

(c) Explain, with supporting calculations:

(i) the reasons for the change in manufacturing profit between Periods 1 and 2 where absorption costing is used in each period;

(5 marks)

(ii) why the manufacturing profit in

(a) and (b)

differs.

Step by Step Answer: