Profitability analysis and a decision on further processing C Ltd operates a process which produces three joint

Question:

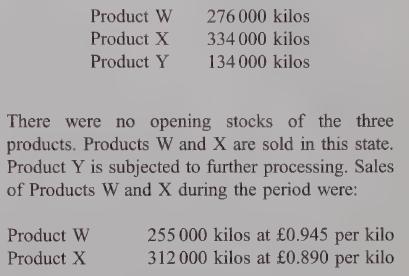

Profitability analysis and a decision on further processing C Ltd operates a process which produces three joint products. In the period just ended costs of production totalled £509640. Output from the process during the period was:

128 000 kilos of Product Y were further processed during the period. The balance of the period production of the three products W, X and Y remained in stock at the end of the period. The value of closing stock of individual products is calculated by apportioning costs according to weight of output.

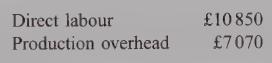

The additional costs in the period of further processing Product Y, which is converted into Product Z, were:

96000 kilos of Product Z were produced from the 128000 kilos of Product Y. A by-product BP is also produced which can be sold for £0.12 per kilo.

8000 kilos of BP were produced and sold in the period.

Sales of Product Z during the period were 94000 kilos, with a total revenue of £100110.

Opening stock of Product Z was 8000 kilos, valued at £8640. The FIFO method is used for pricing transfers of Product Z to cost of sales.

Selling and administration costs are charged to all main products when sold, at 10% of revenue.

Required:

(a) Prepare a profit and loss account for the period, identifying separately the profitability of each of the three main products.

(b) C Ltd has now received an offer from another company to purchase the total output of Product Y (i.e. before further processing) for £0.62 per kilo. Calculate the viability of this alternative. (5 marks)

(c) Discuss briefly the methods of, and rationale for, joint cost apportionment.

Step by Step Answer: