Consider a sad 1-year European contingent claim on a stock. You are given: (i) The time-0 stock

Question:

Consider a “sad” 1-year European contingent claim on a stock. You are given:

(i) The time-0 stock price is 70.

(ii) The stock pays dividends continuously at a rate proportional to its price. The dividend yield is 3%.

(iii) The continuously compounded risk-free interest rate is 6%.

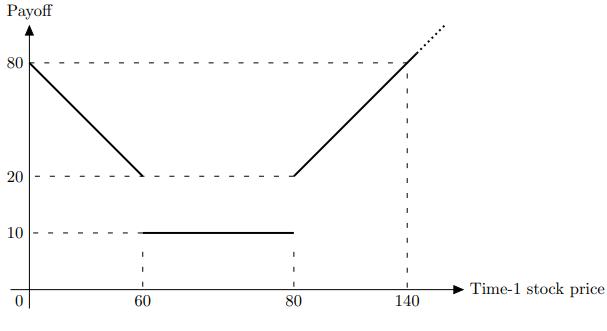

(iv) The time-1 payoff diagram (not drawn to scale) of the contingent claim is described by the following “sad” face:

Let C(K1, K2) be the time-0 price of a 1-year European gap call option on the above stock with a strike price of K1 and a payment trigger of K2. Let P(K1, K2) be the time-0 price of an otherwise identical gap put option.

Determine whether each of the following is a correct expression for the time-0 price of the contingent claim.

(A) P(70, 60) + C(70, 80) + 10e−0.06

(B) C(70, 60) + C(70, 80) − 70e−0.03 + 80e−0.06

(C) C(70, 60) + C(70, 80) − 70e−0.03 + 70e−0.06

(D) P(70, 60) + P(70, 80) + 70e−0.03 − 60e−0.06

(E) P(70, 60) + P(70, 80) + 70e−0.03 − 70e−0.06

Step by Step Answer: