In practice, bond prices are never available at conveniently spaced intervals. Some interpolation scheme is called for.

Question:

In practice, bond prices are never available at conveniently spaced intervals. Some interpolation scheme is called for. However, by making an assumption of constant forward rates between non-standard maturities, we can develop a spot rate curve even for unequal time intervals. In this question, you will undertake a simple exercise of this type.

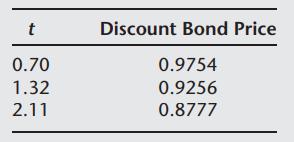

You are given the following discount bond prices at times t:

All compounding and discounting are continuous.

(a) Assuming that forward rates are constant between these dates, find these forward rates.

(b) Price a two-year $100 face value bond that pays 10% p.a. semiannually.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: