Yaesu America wishes to enhance their already fine line of electronic equipment for commercial and individual use.

Question:

Yaesu America wishes to enhance their already fine line of electronic equipment for commercial and individual use.

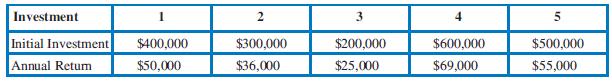

Their engineering staff has proposed five independent, divisible, equal-lived investments, cutting across different product lines, with each estimated to return the initial investment if it is exited after a 5-year planning horizon. In addition, each year, Yaesu is projected to receive an annual return as noted below. They have available $1,250,000 to invest, and their MARR is 10 percent.

a. Determine the optimum portfolio, including which investments are fully or partially selected (if partial, give percentage). You may use Excel®; do not use SOLVER.

b. Determine the optimum portfolio and its PW, specifying which investments are fully or partially (give percentage)

selected using (1) the current limit on investment capital, (2) plus 20 percent, and (3) minus 20 percent. Use Excel®

and SOLVER.

c. Determine the optimum portfolio and its PW, specifying which investments are fully or partially (give percentage) selected using (1) the current MARR, (2) plus 20 percent, and (3) minus 20 percent. Use Excel®

and SOLVER.

d. Determine the optimum investment portfolio and its PW when Investments 2 and 4 are divisible and Investments 1, 3, and 5 are indivisible. Use Excel® and SOLVER.

Step by Step Answer:

Principles Of Engineering Economic Analysis

ISBN: 9781118163832

6th Edition

Authors: John A. White, Kenneth E. Case, David B. Pratt