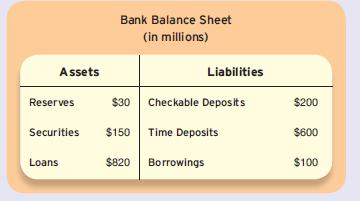

Suppose you were the manager of a bank with the following balance sheet. You are required to

Question:

Suppose you were the manager of a bank with the following balance sheet.

You are required to hold 10 percent of checkable deposits as reserves. If you were faced with unexpected withdrawals of $30 million from time deposits, would you rather

a. Draw down $10 million excess reserves and borrow $20 million from the Fed?

b. Draw down $10 million excess reserves and sell securities of $20 million?

Explain your choice.

Step by Step Answer:

Related Book For

Money Banking And Financial Markets

ISBN: 9780073375908

3rd Edition

Authors: Stephen Cecchetti, Kermit Schoenholtz

Question Posted: