Based on Exhibit 3, and assuming interest on debt is tax-deductible, the weighted average cost of capital

Question:

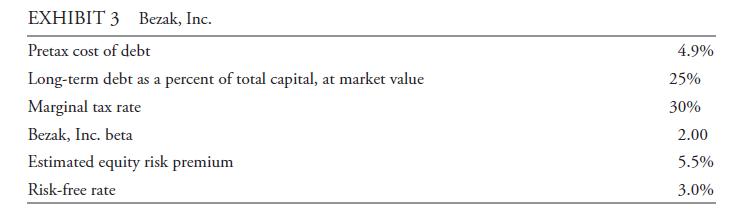

Based on Exhibit 3, and assuming interest on debt is tax-deductible, the weighted average cost of capital (WACC) for Bezak, Inc. is closest to:

A. 10.87%.

B. 11.36%.

C. 13.61%.

Judy Chen is the primary portfolio manager of the global equities portfolio at Horizon Asset Management. Lars Johansson, a recently hired equity analyst, has been assigned to Chen to assist her with the portfolio.

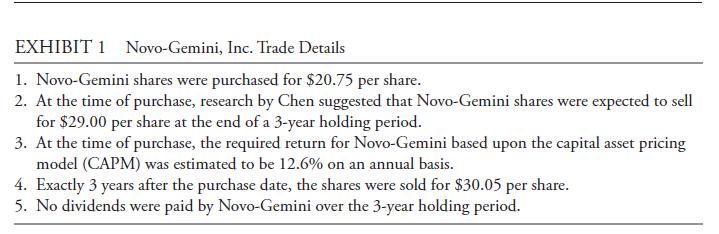

Chen recently sold shares of Novo-Gemini, Inc. from the portfolio. Chen tasks Johansson with assessing the return performance of Novo-Gemini, with specific trade information provided in Exhibit 1.

Chen explains to Johansson that, at the time of purchase, the CAPM used to estimate a required return for Novo-Gemini incorporated an unadjusted historical equity risk premium estimate for the US equity market. Chen notes that the US equities market has experienced a meaningful string of favorable inflation and productivity surprises in the past. She asks Johansson whether the historical equity risk premium should have been adjusted before estimating the required return for Novo-Gemini.

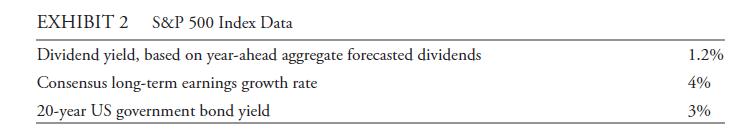

For another perspective on the reward to bearing risk, Chen asks Johansson to calculate a forward-looking equity risk premium for the US equity market using data on the S&P 500 index in Exhibit 2.

Chen is now considering adding shares of Bezak, Inc. to the portfolio. Chen asks Johansson to calculate Bezak’s weighted average cost of capital using the CAPM with the information provided in Exhibit 3.

Lastly, Chen asks Johansson to evaluate Twin Industries, a privately owned US company that may initiate a public stock offering. Johansson decides to adapt CAPM to estimate the required return on equity for Twin Industries. Using the MSCI / Standard & Poor’s Global Industry Classification Standard (GICS), Johansson identifies a publicly traded peer company with an estimated beta of 1.09 that is much larger but otherwise similar to Twin Industries.

Twin Industries is funded 49% by debt, while the publicly traded peer company is funded 60% by debt.

Step by Step Answer: