Upton Computers makes bulk purchases of small computers, stocks them in conveniently located warehouses, ships them to

Question:

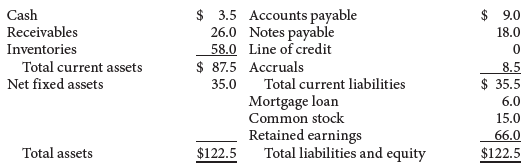

Upton Computers makes bulk purchases of small computers, stocks them in conveniently located warehouses, ships them to its chain of retail stores, and has a staff to advise customers and help them set up their new computers. Upton?s balance sheet as of December 31, 2019, is shown here (millions of dollars):

Sales for 2019 were $350 million, and net income for the year was $10.5 million, so the firm?s profit margin was 3.0%. Upton paid dividends of $4.2 million to common stockholders, so its payout ratio was 40%. Its tax rate was 25%, and it operated at full capacity. Assume that all assets/sales ratios, (spontaneous liabilities)/sales ratios, the profit margin, and the payout ratio remain constant in 2020.

a. If sales are projected to increase by $70 million, or 20%, during 2020, use the AFN equation to determine Upton?s projected external capital requirements.

b. Using the AFN equation, determine Upton?s self-supporting growth rate. That is, what is the maximum growth rate the firm can achieve without having to employ nonspontaneous external funds?

c. Use the forecasted financial statement method to forecast Upton?s balance sheet for December 31, 2020. Assume that all additional external capital is raised as a line of credit at the end of the year. (Because the debt is added at the end of the year, there will be no additional interest expense due to the new debt.) Assume Upton?s profit margin and dividend payout ratio will be the same in 2020 as they were in 2019. What is the amount of the line of credit reported on the 2020 forecasted balance sheets? (Hint: You don?t need to forecast the income statements because the line of credit is taken out on the last day of the year and you are given the projected sales, profit margin, and dividend payout ratio; these figures allow you to calculate the 2020 addition to retained earnings for the balance sheet without actually constructing a full income statement.

StocksStocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Corporate Finance A Focused Approach

ISBN: 978-1337909747

7th edition

Authors: Michael C. Ehrhardt, Eugene F. Brigham