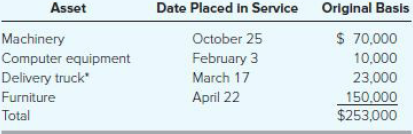

Convers Corporation (calendar-yearend) acquired the following assets during the current tax year: *The delivery truck is not

Question:

*The delivery truck is not a luxury automobile. In addition to these assets, Convers installed new flooring (qualified improvement property) to its office building on May 12 at a cost of $300,000.

a. What is the allowable MACRS depreciation on Convers€™s property in the current year assuming Convers does not elect §179 expense and elects out of bonus depreciation?

b. What is the allowable MACRS depreciation on Convers€™s property in the current year assuming Convers does not elect out of bonus depreciation (but does not take §179 expense)

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Essentials Of Federal Taxation 2019

ISBN: 9781260190045

10th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Question Posted: