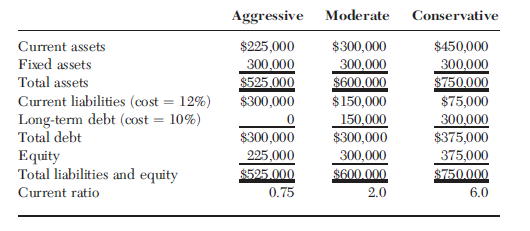

Three companiesAggressive, Moderate, and Conservativehave different working capital management policies as implied by their names. For example,

Question:

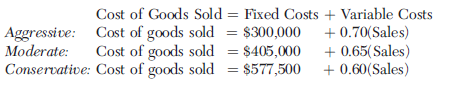

The cost of goods sold functions for the three firms are as follows: Because of the working capital differences, sales for the three firms underdifferent economic conditions are expected to vary as follows:

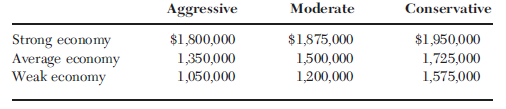

Because of the working capital differences, sales for the three firms underdifferent economic conditions are expected to vary as follows:

a. Construct income statements for each company for strong, average, and weak economies using the following format:

Sales

Less: Cost of goods sold

Earnings before interest and taxes (EBIT)

Less: Interest expense

Earnings before taxes (EBT)

Less: Taxes (at 40%)

Net income (NI)

b. Compare the returns on equity for the companies. Which company is best in a strong economy? In an average economy? In a weak economy?

c. Suppose that, with sales at the average-economy level, short-term interest rates rose to 20 percent. How would this affect the three firms?

d. Suppose that because of production slowdowns caused by inventory shortages, the aggressive company€™s variable cost ratio rose to 80 percent. What would happen to its ROE? Assume a short-term interest rate of 12 percent.

e. What considerations for the management of working capital are indicated by this problem?

Step by Step Answer:

Essentials of Managerial Finance

ISBN: 978-0324422702

14th edition

Authors: Scott Besley, Eugene F. Brigham